13 May 2019

Weekly Market Review (13 May 2019) - What happened & What's next?

Market update

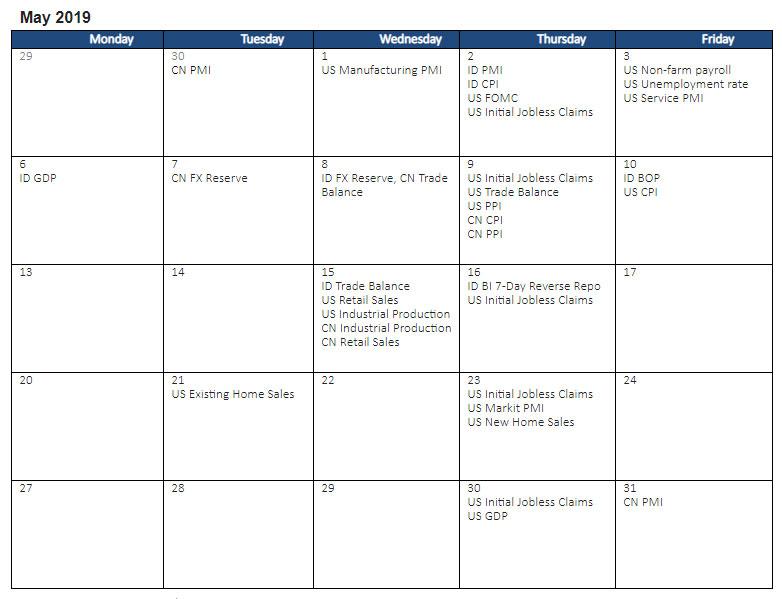

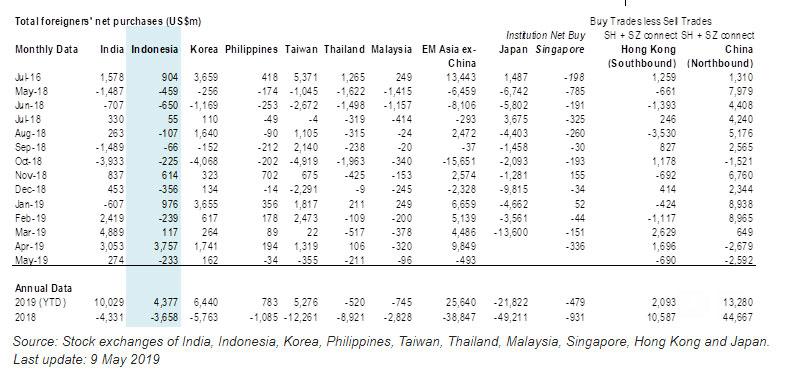

- After the trade talks hit a wall last week, the Trump administration unexpectedly decided to increase tariffs to 25% (from 10%) on USD200bn worth of Chinese imports. Subsequently, Asian equities slumped by -4.9%WoW. While there has been some reconciliatory tone from the US and China on Friday after Asian markets shut, there remains considerable uncertainty over the next steps of trade talks. Markets remain highly sensitive to trade-talks given expectations of some form of a trade-agreement ahead of these tensions. Hence, volatility is expected to remain high in the near term. On domestic side, JCI plummeted to IDR6,209.1 (-1.7%WoW) by the end of the week, dragged down by foreign outflow of USD211m. Mining sector was the worst performer with -4.4%WoW as trade tension intensified. Meanwhile, Consumer sector was the only sector that moving to positive direction (+1.5%WoW). News flows to be watched within this week include Indonesia Trade Balance and BI 7-Day Reverse Repo; China Retail Sales and Industrial Production; US Retail Sales, Industrial Production and initial jobless claim.

- IDR fell to IDR14,327 (-0.4%WoW), relatively in-line with average emerging markets (-0.3%WoW). On the other hand, DXY fell to 97.3 (-0.2%WoW).

- After US increased tariffs from 10% to 25% on USD200bn good from China, IDR bond market yield increased by 4-20 bps. 20 year yield increased the most.

- Foreign investor decreased position by IDR0.7trn, mostly seen on 5 years series.

- US Treasury yield decreased from 2.54% to 2.47% over the week after US raise tariffs to 25% on USD200bn of Chinese exports.

Global news

- US Initial Jobless Claims dropped 2,000 to a seasonally adjusted 228,000 for the week ended May 4. It fell less than market expectation of 220,000.

- U.S. trade deficit rose a modest 1.5% in March’19 to a seasonally adjusted USD50bn, slightly smaller than expectations for a USD50.2bn trade gap.

- China’s FX reserves dropped to USD3.095trn in April’19 from USD3.099trn in March’19, the first monthly decline in six months.

- China’s consumer price index (CPI) in April’19 rose 2.5%YoY, meeting analysts’ expectations and slightly higher than the 2.3%YoY in March.

- China’s Producer price inflation (PPI) rose +0.9%YoY in April, the fastest pace since Dec’2018. That was up from a +0.4%YoY increase in March, and higher than the +0.6% increase economists expected.

- There are three key sources of disagreement on US- China trade talks: Beijing demands US remove all additional tariffs; on targets that are set by the US on goods to be purchased by China; and the wording of the agreement’s text.

Domestic News

- Current account deficit narrowed to USD7bn or 2.6% of GDP in 1Q19 (vs a deficit of USD9.2bn or 3.6% of GDP in 4Q18). This marks the first improvement in the current account since 1Q17.

- Balance of payments (BOP) recorded a surplus of USD2.4bn, compared to USD5.4bn previously. Surplus in the BOP likely contributed to the rise in forex reserves during the early part of the quarter, and used along with efforts to maintain IDR stability.

- Indonesia’s 1Q19 real GDP slipped to +5.07%YoY from +5.18%YoY in 4Q18, a level slightly below consensus expectation at 5.20%. In summary, government expenditure, non-profit institutions spending, and net exports recorded improvement, while slowdown occurred in private consumption and gross fixed capital formation. Of those last two, the GFCF was the main source of slowdown.

- FX Reserve reached USD124.3bn in Apr19, which was relatively stable compare to the previous month at USD124.5bn. the reserve position is equivalent to finance 7.0 months of imports, well above the minimum threshold of 3 months of imports.