14 June 2021

Weekly Market Review (14 June 2021) - What happened and What's Next?

Market update

- Global indices mixed with S&P and MSCI Asia ex-Japan slightly up by +0.4%WoW and +0.1%WoW, respectively, while DJIA slipped slightly by -0.8%WoW. The mixed data reading continued where market saw US inflation stronger than expected, but labour market was tight with record high job opening. Rangebound US treasury yield indicates market saw certainty over global monetary policy which remain supportive. All eyes will focus on the Federal Reserve meeting ahead this week where investors expect a little shift on the Fed median dot plot and inflation projection to be improved somewhat. The Fed might still view job gains when weighing taper timing. On the domestic side, JCI index book a slight gain, up by +0.5%WoW (net inflow of IDR4.6tn MTD or IDR16.4tn YTD). Indonesia daily confirmed cases last week rose by +69%WoW which then the government extended its PPKM Micro (Selective restriction) with 75% WFH regulation and activity halt in worship places for red zones. The most outperformed sector was Technology, up by +52.4%WoW then followed by Transportation and Logistic sector, up by +5.1%WoW. Property and Real Estate sector was the most underperformer, down by -2.4% WoW. News Flows to be watched within this week: US Retail Sales, Industrial Production; China Unemployment Rate, Retail Sales, Industrial Production, Fixed Asset Investment, FDI; Indonesia Trade Balance, Interest rate decision.

- Rupiah strengthened slightly by 0.7% WoW to USD/IDR 14,189, outperforming other EM peers. Meanwhile, DXY index also strengthened slightly to 90.6 (+0.5% WoW).

- Indonesian government bonds’ prices rallied as yield lowered by 2-25bps along the curve. Yield on the 3 and 7yr were decreased the most as BI moved to slash its OMO liquidity absorption rate. Previously excess cash from Bank were rolled via RR and TD at 90-100% absorption rate, was now cut to only 75% and then 50% absorption rate. By the end of last week, yield on 10y INDOGB was reported at 6.33% (-8bps WoW).

- Incoming bids in the latest conventional auction remained solid at IDR78.46tn compared to previous auction bid of IDR78.16tn. Demand on for medium and long tenor terms continued improving with the biggest rebound on the 10yr tenor, as its incoming bids rose by IDR7.5tn (+29%) reaching IDR33.7tn compared to previous auction. The government finally issued IDR34tn, slightly higher than initial target of IDR30tn.

- Based on DMO data, foreign ownership as of 10th June 2021 was reported at IDR978.56tn or 22.97%.

- US treasury yields move in range with yield dropped by 10bps due to the release of US consumer prices rose in May to 5% as reopening economy boosted demand for travel-related services. By the end of last week, 10y UST reported at 1.47%(-9bps WoW).

Global news

- US April Trade Balance recorded deficit of USD-68.9bn in line with consensus estimation of USD-68.7bn, improved from prior deficit of USD-74.4bn

- US April job opening rose to a record high +9,286k where the largest increases in accommodation and food services. This was higher than consensus estimation of +8,200k and prior figure of +8,123k.

- US Initial Jobless Claims added +376k slightly higher than consensus +370k but lower than prior figure of +385k. This was the sixth-consecutive decline to a new pandemic low.

- US May Consumer Price Index (CPI) headline up by +5%YoY, highest since Aug-2008, was above than consensus estimation of +4.7%YoY, prior month +4.2%YoY. CPI exclude Food and Energy up by +3.8%YoY, higher than consensus estimation of +3.5%YoY (prior month +3%YoY).

- China May CPI up by +1.3%YoY lower than consensus estimation of +1.6%YoY, but higher than prior figure of +0.9%YoY while Producer Price Index (PPI) up by +9%YoY higher than consensus estimation of +8.5%YoY and prior +6.8%YoY.

Domestic News

- Bank Indonesia recorded Indonesia April retail sales index of 220.4, grew by +17.3%MoM, 15.6%YoY (Prior +6.1%MoM, -14.6%YoY), the fastest pace since Jun 2016. The index surged due to increasing sales in all groups, particularly clothing and fuel.

- Indonesia May Foreign Reserves stood at USD136.40bn lower than prior month of USD138.8bn. The declining foreign reserves to the lowest level since Dec-20 partly due to the government’s external debt payment. However, the foreign reserves were equivalent to 9.1mths of imports and govt's external debt payments, well above the threshold.

- The Bank Indonesia Consumer Survey (SK) in May 2021 showed that consumer optimism about economic conditions had continued to strengthen. This was reflected in the May 2021 Consumer Confidence Index (IKK) of 104.4 increased from the April 2021 IKK of 101.5.

- The Parliament (DPR) together with the government approved some macro assumptions for 2022 budget. Economic growth is targeted in range of 5.2-5.8%, inflation rate at 2-4%, IDR/USD in range of 13,900-15,000, the 10y bond yield in range of 6.32-7.27%, oil price USD55-70/barrel. For the government budget, tax ratio is targeted in range of 8.37-8.42%.

- The government extended the March 100% luxury tax relaxation for car (under 1500cc) to end in Aug2021 instead of May2021, then 50% discount for the period Sep-Dec 2021.

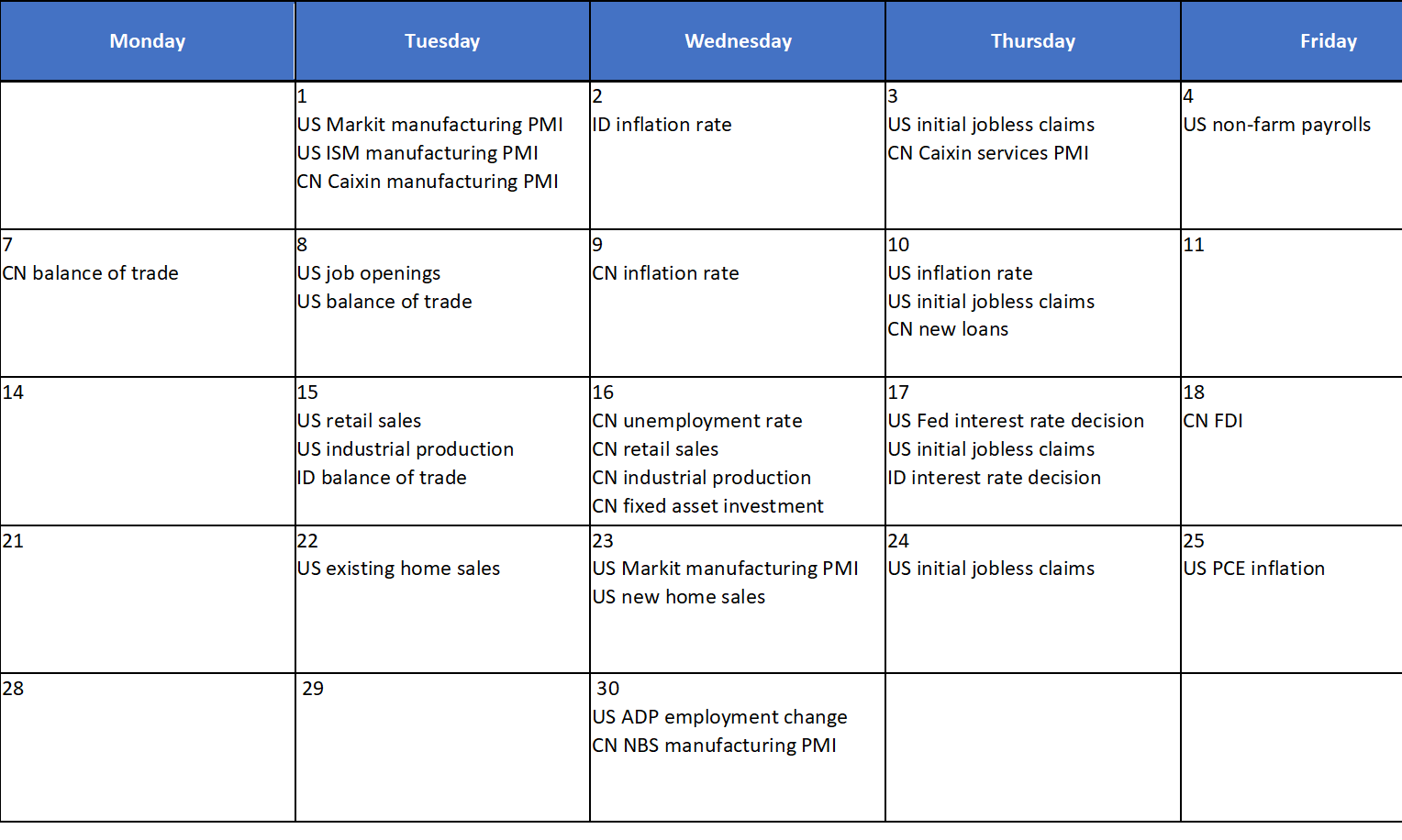

Calendar

June 2021

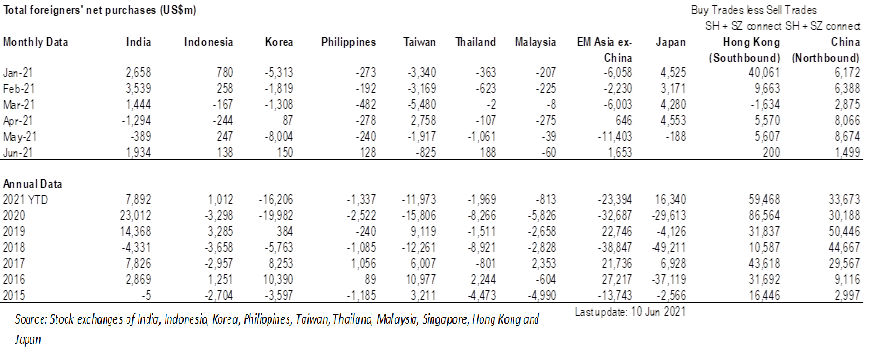

EM Equities net foreign flow