05 July 2021

Weekly Market Review (5 July 2021) - What happened and What's Next?

Market update

- US equities recorded at new highs but Asia down. S&P and DJI gained up by +1.7%WoW and +1.0%WoW, respectively, even when UST 10y declined 10bps WoW and amid recent surging on covid cases due to delta variant. Market saw a reversal in reflation trade where technology sector outperformed sectors sensitive to economic growth (such as banks and energy). Meanwhile MSCI Asia ex-Japan posted losses, down by -1.9%WoW, whereby China as underperformer. Market will continue to monitor the Fed monitory outlook (after US non-farm payroll beat consensus 850k vs 720k), the progress of US earning season and delta variant. Noting that the global covid cases has increased globally and remained elevated in some parts of Asia, weighing the global growth recovery. On the domestic side, JCI index was flat (+0.01%WoW) at IDR6,023, despite Indonesia recorded new high for covid cases and the government imposed PPKM emergency in Jawa-Bali starting 3 July to 20 July, which will be evaluated afterwards. The sectors were mixed with the most outperformed sector was Consumer Non-Cyclical, up by +3.8% WoW. Infrastructure and Basic Materials sectors were the main underperformers, down by -3.9% WoW and -2.5% WoW, respectively. News Flows to be watched within this week: US FOMC meeting minutes, Markit PMI, initial jobless claims; China foreign reserves, inflation rate.

- Rupiah weakened by 0.7% WoW to USD/IDR 14,533, in line with other EM peers. In contrast, DXY index strengthen to 92.2 (0.4% WoW).

- Indonesia government bonds’ yields were 2-8bps higher along the curve as government imposed a stricter measure as rising covid cases, including closing malls and public places. MOF also announce their Q3 issuance calendar and will increase issuance size for next conventional auction to IDR33tn from IDR30tn. There will be new benchmark series introduced in the auction for 5yr, 10yr and 20yr. By the end of last week, 10yr INDOGB was at 6.57% (+4bps WoW)

- Incoming bids on Tuesday Sukuk was booked very high at IDR48.68tn compared to IDR46.67tn on the previous auction. The government decided not to issue SPNS6mo and PBS29 (13yr) in this auction. At last, the government finally issued IDR12.5tn.

- Based on DMO data, foreign ownership as of 30th June 2021 was reported at IDR977.31 Tn or 22.82%.

- US Treasury yields were lower after a strong payroll report left uncertainty about the Fed response. By the end of last week, 10y UST yield closed at 1.44% (-10bps WoW).

Global news

- The OPEC+ meeting on Friday ended on a deadlock. The standstill came from UAE disagreement over the new oil production quota as it expects OPEC to increase the quota to >400k barrels/day (which had been agreed upon by the OPEC alliance). Thus, the meeting will continue today.

- US non-farm payroll was reported at +850k jobs, better than the expected 706k and 583k in May. The notable gain came from the hospitality (+343k) and education (+269k) sectors.

- US unemployment rate slightly up to 5.9% slightly higher than prior figure of 5.8% and consensus expectation at 5.6%, while wage rate up by 0.3%MoM, or 3.6%YoY.

- US Markit Manufacturing PMI recorded 62.1 (prior 62.6), slightly lower than market consensus at 62.6. Substantial increases in new orders and output growth supported the upturn, but supply and labor shortages still hinder the output growth.

- US trade deficit widened to USD-71.2bn from USD-68.9bn but slightly below market expectation USD-71.3bn.

- US new jobless claims data was recorded at 364k, the lowest in pandemic-era. This lower than market expectation at 388k and prior 411k.

- US ADP Employment Change added +692k higher than consensus expectation +600k but still lower than prior figure +886k.

- China’s Caixin services PMI dropped from 55.1 to 50.3, mainly happened on the back of the recent uptick in COVID19 cases and reduced travel, which in turn led to a dampened demand.

Domestic News

- The government forces to implement PPKM emergency 3-20 July 21. Compared to prior restriction, the stringency is almost as tight the first PSBB (2Q20). Essential sectors to operate 50% capacity and non-essential sector 100% WFH. Malls will be closed (except groceries), restaurant only take away, 70% transportation, intercity transport requirement with vaccination certificate, PCR, Rapid Antigen, etc.

- Ministry of Finance stated that APBN response on PPKM emergency remains sufficient. PEN stimulus is maintained at IDR699tn but some posts are reallocated from initial plan (social aid +1%, healthcare +8%, business incentive +11%, SME support -8%, other priority -4%). Some social program extended to Sept-21 such as in cash handout and electricity fee discount for household and business.

- Considering the surging of covid cases and spreading of delta variant, Ministry of Finance predicted that 2Q21 GDP growth will be at 7.1 – 7.5% (prior forecast 7.1 – 8.3%).

- Indonesia CPI (Consumer Price Index) June-21 recorded a decline of -0.16%MoM and an increase of +1.33%YoY. The deflation was driven by the food, beverages, & tobacco, transportation, and clothing & footwear components.

- Indonesian manufacturing PMI 53.5 in June-21, down from May-21’s record high of 55.3.

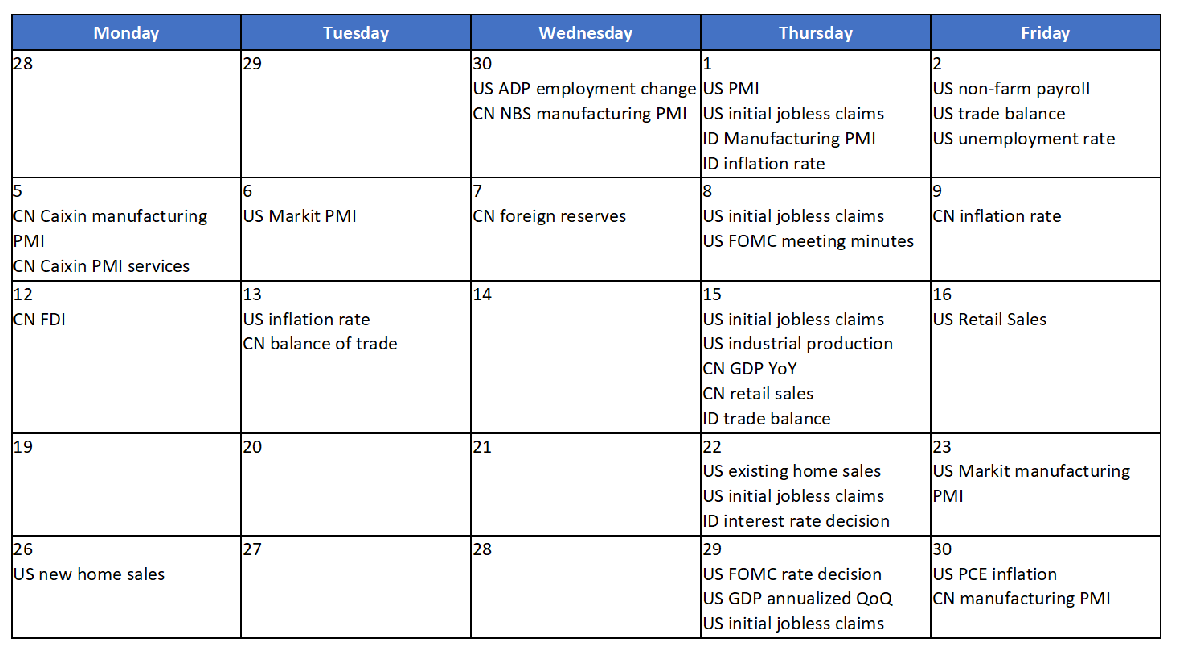

Calendar

July 2021

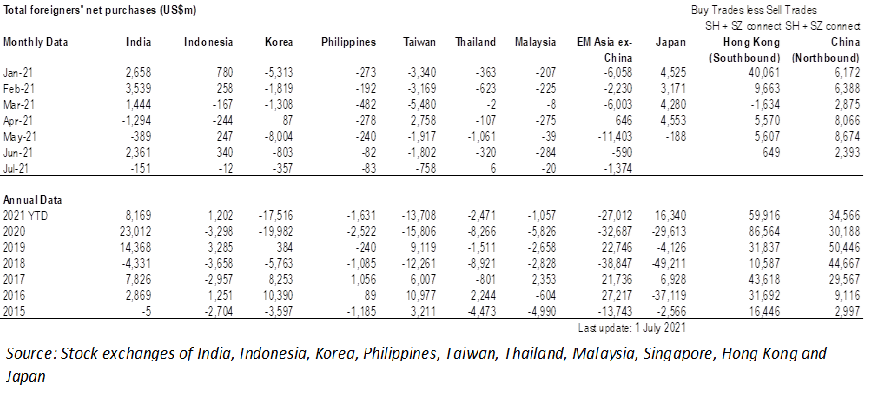

EM Equities net foreign flow

EM Equities net foreign flow