20 May 2019

Weekly Market Review (20 May 2019) - What happened & What's next?

Market update

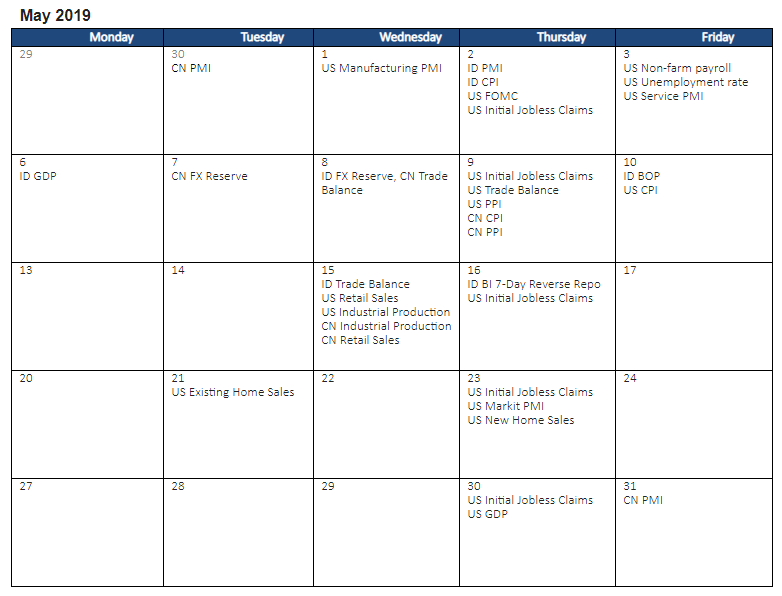

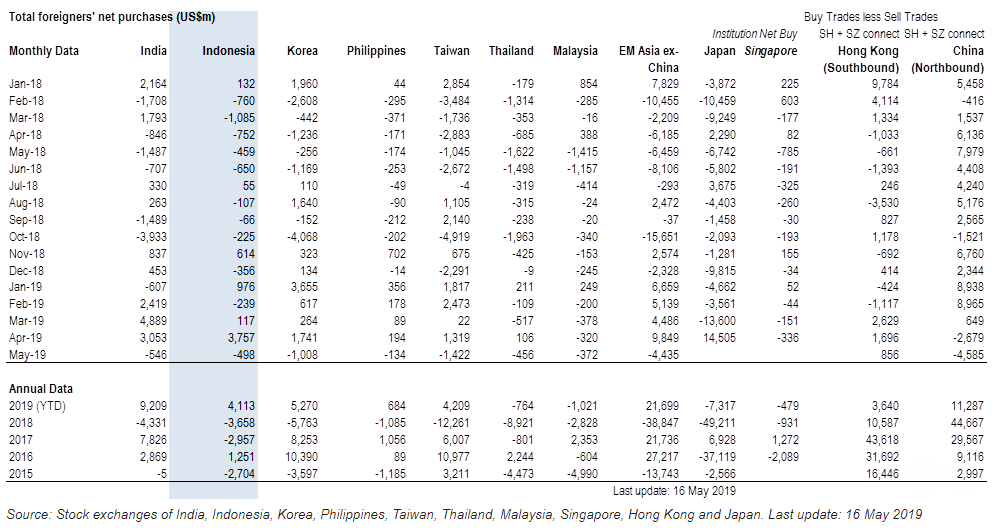

- Global equity sell-off intensified as Asian equities slumped by another 3.5% WoW as China retaliated for US tariff moves by imposing tariffs on some USD60bn worth of US exports, together with the news that suggests US and China trade talks may have stalled. Exacerbating market concerns was disappointing activity data out of China, with weak industrial production (IP), retail sales, new homes sales and fixed asset investment (FAI), and then the US administration’s decision to add Huawei to the Entity List and signing an executive order to ban commercial use of foreign-made telecommunication equipment effectively complicating trade negotiations. On the positive side, China is likely to ramp up its stimulus while US will delay the decision on auto tariffs for up to 6 months and lifted metals tariffs with Canada and Mexico. On domestic side, JCI plummeted to 5,826.87 (-6.2% WoW) by the end of the week due to trade deficit of US2.5bn, underperforming the region with foreign outflow of USD253mn. Basic Industry was the worst performer with -9.3% WoW on the back of weak broiler price and cement data. Meanwhile, Trade sector was the best performer with least decline -2.3% WoW. News flows to be watched within this week include US Markit PMI, home sales and initial jobless claims.

- IDR fell to IDR14,450 (-0.9% WoW), relatively in-line with average emerging markets. On the other hand, DXY fell to 98.0 (+0.7%WoW).

- Concern on trade tension and rupiah made IDR bond market yield increased by 2-6 bps. 10 year yield increased the most.

- Foreign investor decreased position by IDR 7.5 trillion, mostly seen on 10 years series.

- Concern on trade war and a breakdown in Brexit talks in UK made US Treasury yield decreased from 2.47% to 2.39% over the week.

Global news

- China retaliated for US tariff moves by imposing tariffs on some USD60bn worth of US exports.

- US added Huawei to the Entity List and signing an executive order to ban commercial use of foreign-made telecommunication equipment.

- China data: IP growth plunged to 5.4% YoY in April from 8.5% in March. Retail sales growth dropped to 7.2% YoY in April from 8.7% in March. Fixed asset investment (FAI) growth slowed to 5.7% YoY in April from 6.4% in March, taking the year-to-date growth down to 6.1% from 6.3% (2018: 5.9%).

Domestic News

- Indonesia trade deficit widened to US2.5bn in April 2019 vs consensus expectation of US500mn. April exports were down 13.10% on an annual basis at $12.60 billion, led by a drop in shipments of refined oil and natural gas products. Imports fell 6.58% from a year earlier to $15.10 billion.

- Bank Indonesia keeps policy rate unchanged at 6 percent. Lending and deposit rates were also kept at 6.75 and 5.25 percent respectively. The central bank now expects the current account deficit to be recorded between 2.5 and 3 percent of GDP this year, compared to its previous outlook of 2.5 percent of GDP.

- Finance Minister Sri Mulyani Indrawati said that Indonesia will face difficulty in maintaining GDP growth at 5% this year because of the ongoing trade war between the US and China.

- Indonesia's Jan – April tax collection shows signs of economic slowdown. Jan – April tax takes was 4.7% higher vs last year, while overall state revenue was up 0.5%. Govt targets to increase state revenue by 11.5% this year vs 2018.