23 August 2021

Weekly Market Review (23 August 2021) - What happened and What's Next?

Market update

- Global indexes were traded lower last Friday with Dow Jones and S&P down by -1.1% and -0.6% WoW respectively. Investors were concerned about tapering by the Fed, China's restriction on its economy and the spread of delta variant. Minutes of Fed's meeting in July showed plans to consider reducing asset purchases likely by the end of this year although it also suggested interest rates could still stay near zero for some time. In addition, delta variant continues to surge in US causing straining on hospitals in severely affected states. Meanwhile, China's regulatory crackdown is still ongoing with the past week saw the turn of healthcare technology firms as state media called for greater supervision of drugs sold on the internet. On the domestic side, JCI continued to book a loss of -1.8% WoW. All sectors except for financial were traded lower with the main drag comes from technology sector -11.5% WoW. News Flows to be watched within this week: US Markit PMI, US home sales, US durable goods, US initial jobless claims and US personal income.

- Rupiah weakened by -0.5% WoW to IDR 14,453/USD, relatively in-line with other EM currencies. On the other hand, DXY index increased by +1% WoW to 93.5

- Indonesian government bonds yield movements were mixed, ranging between 1-7bps along the curve in which the 10yr INDOGB was reported at 6.37% (+4bps WoW) by the end of last week. The main theme seems to be US tapering headlines versus flushed onshore liquidity.

- Incoming bids on Tuesday’s conventional auction remained solid at IDR 77.07tn but much lower than in the previous auction of IDR 107.78tn. Incoming bids were still supported by medium tenors, with bids of 10.7yr reaching IDR 25.2tn or 32% of total incoming bids. Overall, the government issued IDR 30tn or lower than initial target of IDR 33tn.

- Based on DMO data, foreign ownership as of 19 Aug-21 was reported at IDR 975.29 or 22.55%.

- 10yr UST moves sideways with yield ranging from 1.24-1.27%. Minutes from the July's FOMC meeting released on Wednesday showed that central bank plans to pull back bond purchases before the end of 2021. By the end of last week, 10yr UST was reported at 1.26%.

Global news

- US retail sales growth in July was lower than expected, dropped by -1.1% MoM vs consensus' expectation of -0.3% MoM. The number is also lower than previous month's at +0.7% MoM.

- US industrial production in July grew by +0.9%, better than consensus number at +0.5% and higher than prior number of +0.2%.

- US Initial Jobless Claims added +348k lower than consensus expectation and prior number of +365k and +377k respectively.

- China retail sales only rose +8.5% YoY, lower than expectation of +11.5% YoY and declined from +12.1% YoY in the prior month.

- China industrial production growth increases +6.4% YoY in July, below analysts' forecast at +7.8% YoY and lower than previous month's number of +8.3% YoY.

Domestic News

- 2Q21 balance of payment (BoP) recorded a marginal deficit of –USD0.4bn (1Q21: USD4.1bn) as current account deficit (CAD) widened amid the normalization of primary income deficit while financial account surplus narrowed amid deficit in other investment post. 1H21 BoP surplus USD3.6bn is much larger than in 1H20 (USD0.7bn).

- Bank Indonesia kept its policy rate on hold at 3.5% as expected. The central bank reiterated that it will continue with its efforts to stabilize the local currency and maintain financial stability.

- The government has set a high target for the value added tax next year. In the 2022 Draft State Budget, the government targets VAT revenues of Rp552.3tr, an increase of 10.1% from this year's estimated realization. Minister of Finance Sri Mulyani said that the targeting was based on projections of economic growth in 2022 of around 5%-5.5% and inflation of 3%

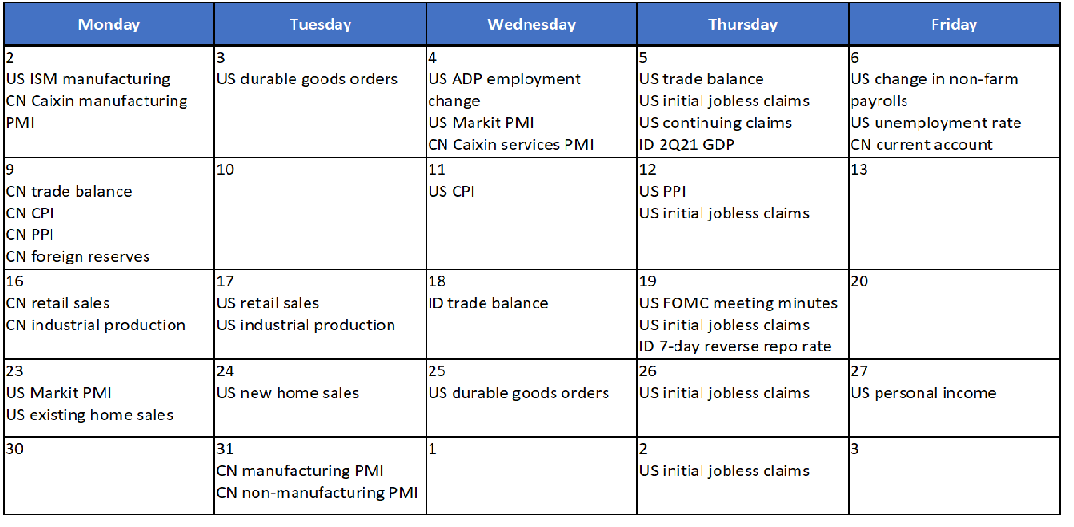

Calender

August 2021

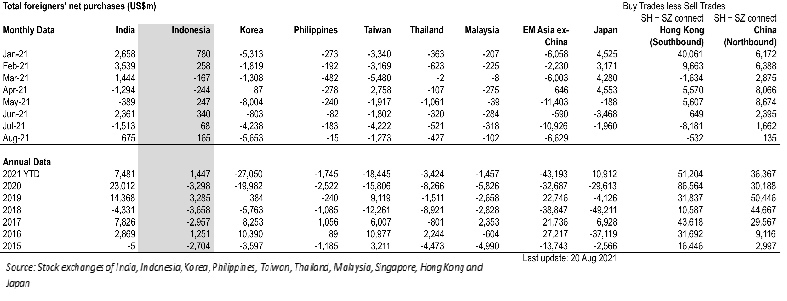

EM Equities net foreign flow

EM Equities net foreign flow