18 October 2021

Weekly Market Review (18 Oct 2021) - What happened and What's Next?

Market update

- Global equity indexes continued its gain momentum by closing the week higher (S&P 500 +1.8%WoW, DJI 1.6%WoW, MSCI Asia ex-Japan 1.9%WoW). US market spurred on the back of robust corporate earnings and alleviated investors’ focus away from inflationary pressure risk. According to FactSet data, as of Friday, 80% of the 41 S&P 500 companies that have reported third-quarter results have topped earnings-per-share expectations. Meanwhile, on the data front, US retail sales grew 0.7% MoM in September, better than consensus expectation of a 0.2% MoM decline. Increasing global optimism spurred investors to enter the riskier assets, reducing demand on the safe-haven assets. Federal Reserve’s minutes affirming a looming reduction in stimulus start mid-Nov/ mid-Dec amid debate over inflation intensifies. In Asia, China slowdown features as a big concern for investors. Yet, PBOC giving assurance over Evergrande case that the risks are “controllable”. On the domestic side, JCI Index continued its rally with a gain of +2.3% WoW (net inflow of IDR6.6tn MTD or IDR33.1tn YTD). The most outperformers were Basic Materials sector and Consumer Non-cyclicals sector, up by respectively 4.2%WoW and 3.1%WoW. In contrast, Transportation and Logistics sectors were the most underperformed down by -3.9% WoW, followed by Technology sector -3.4%WoW. News flows to be watched within this week: US industrial production, market PMI, existing home sales, initial jobless claim; China 3Q21 GDP, retail sales, industrial production

- Rupiah continued to strengthen by 1% WoW to USD/IDR 14,075, outperforming other EM currencies. Meanwhile, DXY index slightly weakened to 93.9 (-0.1%WoW).

- Indonesian government bonds yields were lower by 3-12bps along the curve backed by stronger Rupiah that fall below 14100 level after trade balance data on Sept. INDOGB traded firmer on the back of foreign and local banks buying. Yield on the 10y tenor was reported at 6.19% (-16bps WoW).

- Total incoming bids in Tuesday’s conventional bond auction continued to lower to IDR58.83tn. Demand was still supported by mid to long tenors and dominated by onshore investors, with incoming bids of 5yr and 20tr reaching total of IDR23.8tn or almost 48% of total bids. The government issued IDR8tn as targeted.

- Based on DMO data, foreign ownership as of 13th Oct was reported at IDR953.70tn or 21.40%

- According to September FOMC minutes, the Fed is likely to begin gradual tapering as soon as mid-November and as much as USD 10bn in Treasuries and USD 5bn in MBS per month. Interest rate hikes are also anticipated to start in 2022. By the end of last week, 10y UST was reported at 1.59% (-2bps WoW).

Global news

- IMF lowers 2021’s global growth outlook to 5.9% (prev: 6%). The downgrade revision was made upon the development of persistent supply chain issue across the globe, and worsening pandemic situation on several emerging market countries.

- U.S. President Joe Biden on Thursday signed legislation temporarily raising the government's borrowing limit to USD28.9 trillion, pushing off the deadline for debt default only until December.

- US Job Openings (JOLTSrecorded 10.4mn, lower than consensus estimation 10.9mn and prior figure 11.09mn

- US CPI recorded 5.4%YoY, slightly higher than consensus estimation 5.3%YoY and prior figure 5.3%YoY

- US Initial jobless claim recorded 293k, lower than consensus estimation 320k and prior figure 329k

- US PPI recorded 8.6%YoY slightly below consensus estimation 8.7%YoY, but higher prior figure 8.3%YoY

- The GDP in China expanded 0.20% in 3Q21, slightly lower than consensus estimation 0.4%, lower than prior result of 1.2% in 2Q2021). In terms of yoy basis, the GDP expanded 4.90%, slightly lower than consensus estimation 5.0% and lower than prior figure of 7.9% in 2Q21.

- China retail sales recorded 4.4%YoY, higher than consensus estimation 3.5% and prior 2.5%YoO

- China trade balance recorded USD66.76bn, higher than consensus estimation USD45bn and prior figure USD58.3bn

- China CPI recorded 0.7%YoY slightly below consensus estimation 0.8%YoY and prior figure 0.8%YoY

- China PPI recorded 10.7%YoY slightly above consensus estimation 10.5%YoY, higher than prior figure 9.5%YoY

Domestic News

- September trade balance reported at USD4.37bn higher than consensus estimation USD3.86bn but slightly below prior figure USD4.74bn. Meanwhile, the 3Q21 trade balance is at USD11.71bn, up by +85.73%QoQ (2Q21: USD6.30bn, +14.24%QoQ).

- Retail sales data in August improved to 192.5 (+2.1%MoM, -2.1%YoY), given the gradual COVID19-induced restriction relaxation in areas.

- President Jokowi plans to stop CPO exports so that they can be processed domestically and become value-added derivative products.

- The government obtained investment commitments worth IDR92.9tn in 19 Special Economic Zones (SEZs) in Indonesia. The commitment value increases following the extra establishment of four SEZs on top of the previous 15 SEZs.

- Financial Services Authority (OJK) will issue blueprint of digital bank transformation which will options whether banks can control the fintech through super app ecosystem or banks will be part of the ecosystem that controlled by the fintech, as well regulate data protection and IT architecture

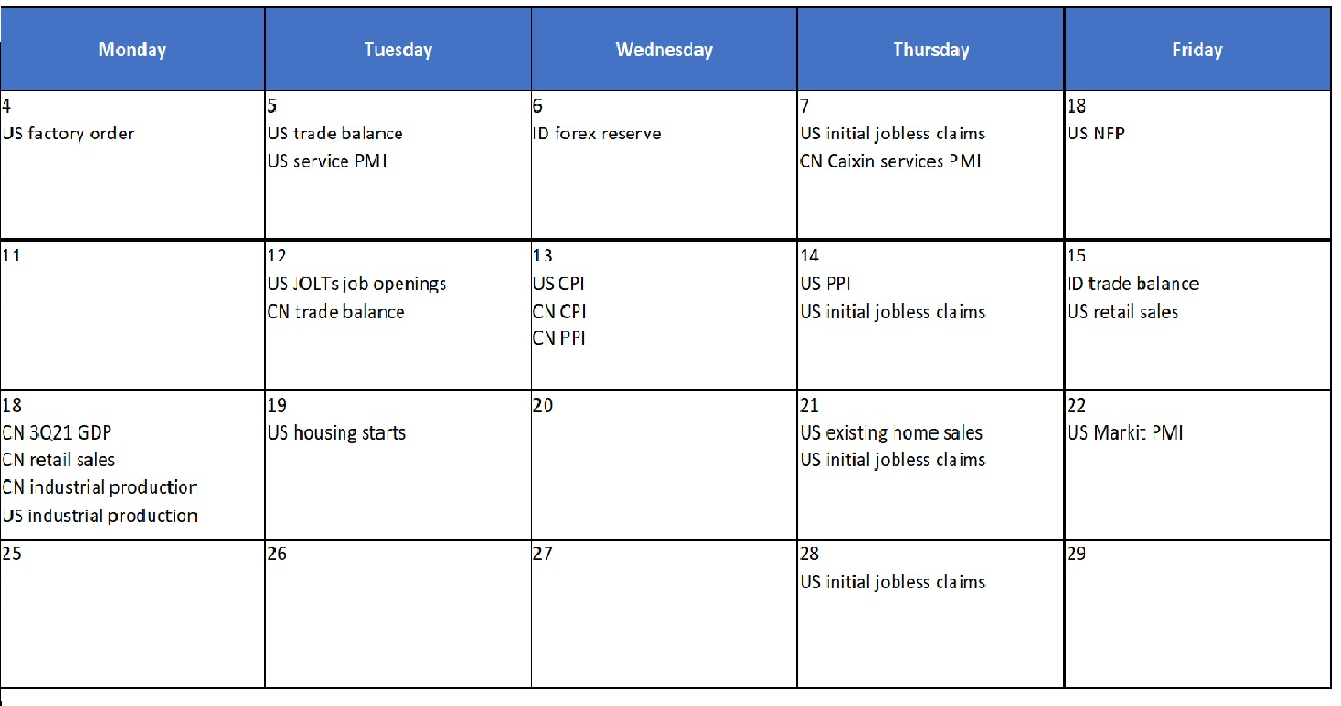

Calendar

October 2021

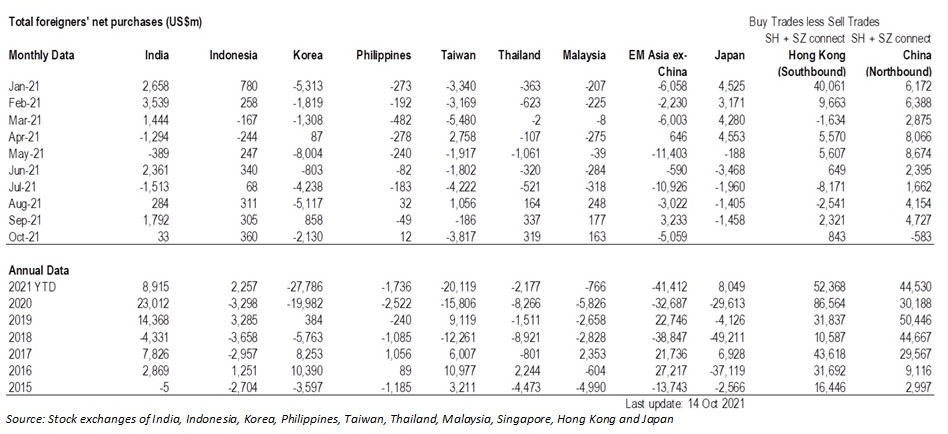

EM Equities net foreign flow