10 June 2019

Weekly Market Review (10 June 2019) - What happened & What's next?

Market update

- During long holiday last week, financial market turned positive both in equity and also bond market, on the back of dovish major central banks (Fed and ECB). S&P jumped 4.4% WoW, one of the highest weekly gain in 2019, while MSCI EM went up by 0.9%. On 31 May, our last trading before long holiday, S&P upgraded Indonesia rating to BBB with stable outlook, in line with Fitch and Moody’s. This brought positive catalyst to the market in the short term with JCI went up by 1.7% and IDR appreciated 1% on that day.

- Rupiah strengthened by 1% on the last week of May, after the rating upgrade. While DXY/USD index posted a loss of -1.2% last week as Fed guided that they are ready to cut rate and weak US data.

- Indonesia rating upgrade by S&P made bond yield decreased by 2-4 bps and stronger IDR. 20 year yield decreased the most.

- Dovish Fed statement and lower than expected US jobs data made 10 years US Treasury yield decreased from 2.14% to 2.09%.

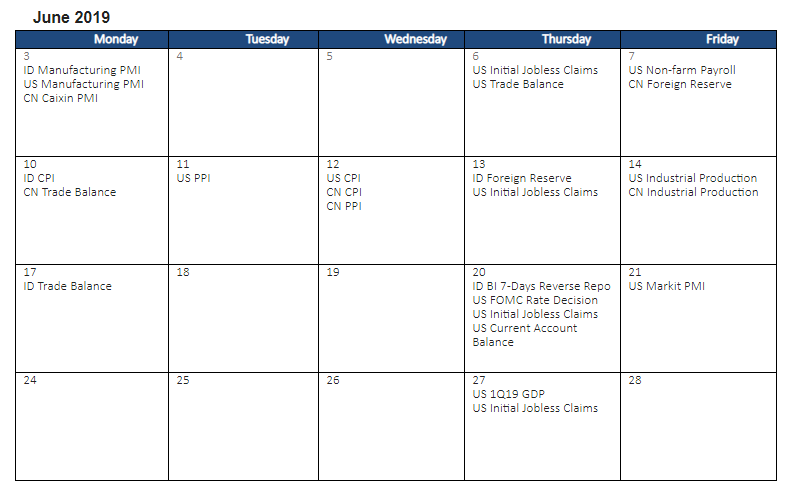

- Market continue to watch US-China trade newsflow before G20 meeting in 28-29 June. Meanwhile, Fed meeting will be done next week amid rising expectation of rate cut.

Global news

- Fed hint that they are ready to cut the rate on the back of weaker economy data and rising tension of trade war. ECB also guided the similar view recently and pushed back the timing of potential rate hike.

- US non-farm payroll was disappointed, only +75k in May 2019 VS expectation of 185k.

- US-Mexico reached a trade deal to avoid the tariff increase as Mexico agreed to take ‘strong measures’ to slow migration over border.

Domestic News

- S&P upgraded Indonesia’s sovereign credit rating from BBB- to BBB with stable outlook, inline with Fitch and Moody’s. Key factors that support the rating updates Indonesia’s strong economic growth prospects and supportive policy dynamics following the re-election of President Joko Widodo. In addition, Indonesia’s relatively low debt and its moderate fiscal performance also supported the rating updates.