28 March 2022

Weekly Market Review (28 March 2022) - What happened and What's Next

Market update

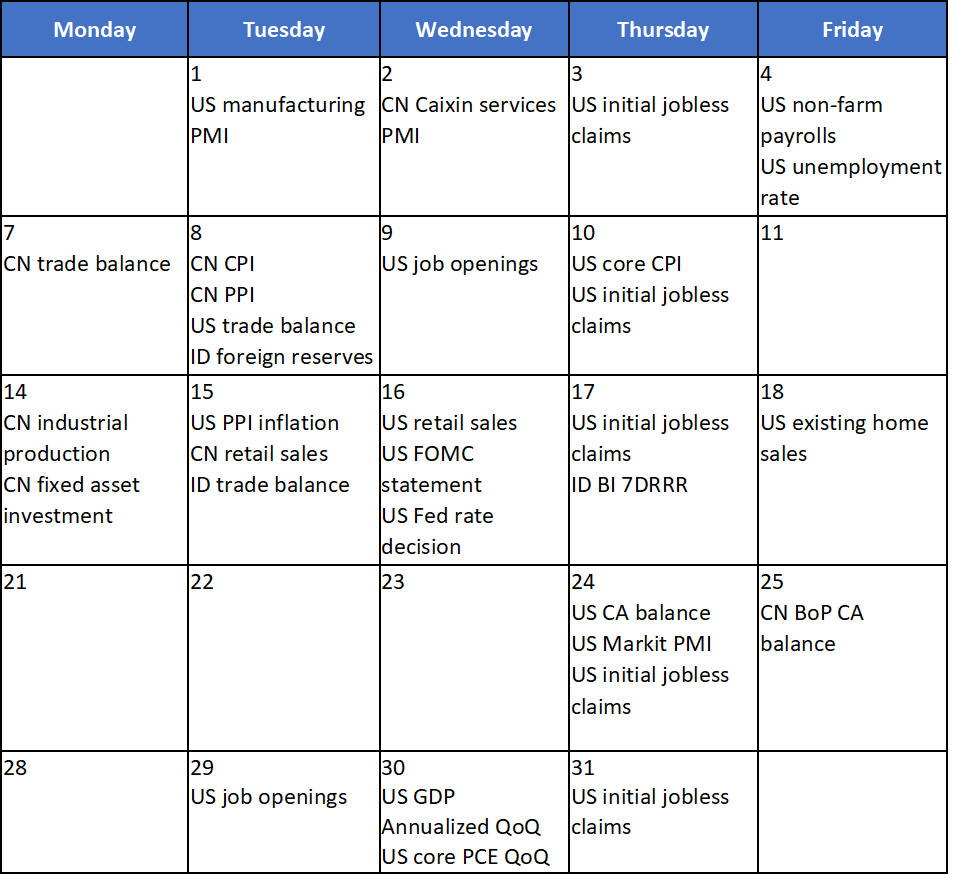

- Global indexes were closed mixed last week following choppy trade on the back of reports of a missile strike on a Saudi Aramco facility. Oil futures turned higher as attack caused an explosion and fire at the facility. Meanwhile, the Federal Reserve’s monetary policy and the Russia-Ukraine war remained in focus for investors. On the domestic side, JCI booked a slight gain of +0.7% WoW. Transportation & logistic sector was the most outperformer, booked a gain of +4.7% WoW. On the contrary, infrastructure sector was the main drag, down by -2.4% WoW. News flows to be watched within this week: US job openings, US GDP annualized QoQ, US core PCE QoQ and US initial jobless claims.

- Rupiah slightly depreciated by -0.01% WoW to IDR 14,341, relatively in line with EM currencies' performance. Meanwhile, DXY appreciates by +0.6% WoW to 98.8.

- INDOGBs were mixed this week, with 10yr was reported at 6.68% (-3bps WoW). MOF plans to reduce its 2022 bond issuance target by at least IDR 100tn to better manage the financing of its fiscal deficit amid rising global uncertainty.

- Total incoming bids in Tuesday’s sukuk auction lowered to IDR 13.8tn compared to IDR 15tn in previous auction. Compared to the previous auction, demand for shorter tenors lowered but medium to longer tenor bids improved. The government issued only IDR 2.8tn, much lower than issuance target of IDR 9tn. Government also accepted all incoming bids of IDR 2.19tn in GSO, added to the regular auction Government only issued a total IDR 4.99tn in this Sukuk auction.

- Government also did the first global bond issuance this year, with total size of USD 1.75bn, offering 10yr and 30yr tenors yielding 3.6% and 4.35% respectively. Debt switch auction also held this week on 24th March, buying back 1-3yr papers and issued benchmark 5-20yr in return. Total demand reaching IDR 5.9tn and the government absorbed IDR 3.8tn. Thus, this debt switching program lengthened the government’s tenor liability by 13.6yrs.

- US yields move higher amid growing expectations that the Fed will be more aggressive in its tightening cycle. Earlier this week, Fed Powell said that policy makers were prepared to raise benchmark rates by more than 25bps in the future meetings if needed to rein in inflation. Meanwhile the yield curve has flattened significantly in recent months, with investors now looking for the 2yr yield to eventually move above the 10yr yield. By the end of the week, 10yr UST was reported at 2.48% (+34bps WoW).

Global news

- US new home sales in Feb-22, was at 772k, lower than expectation of 805k and prior month's figure of 788k.

- US initial jobless claims added +187k lower than consensus' estimation of +210k and prior +215k.

- US markit manufacturing was at 58,5 in Mar-22, higher than consensus' estimation of 57 and prior 57.3.

- China's current account registered a surplus of 2.04tn yuan in 2021, and its capital and financial accounts recorded a deficit of 973.2bn yuan.

Domestic News

- Ministry of Energy and Mineral Resources (ESDM) has prolonged US$90/ton coal price for cement and fertilizer industry, which was previously ended on 31Mar. This time, there is no expiration date for the special price policy.

- IMF cuts Indonesia’s 2022F growth projection to +5.4% YoY (prev: +5.6% YoY), with omicron variant’s spread likely to have impact for 1Q22 growth, although not heavily. As risk to inflation on the back of economic recovery linger, IMF sees that BI should starts to find a way to gradually reduce liquidity.

- M2 position in Feb-22 is reported at IDR7,672.4tn or grew by +12.5% YoY. Growth remained strong compared to Jan-22 12.8% YoY growth. This was driven by slowing growth from quasi-money. With the share of 44.0% of M2, quasi-money recorded at IDR3,374.5tn or grew by +5.9% YoY (prev: +7.8% YoY). Slowdown occurs throughout quasi-money components, namely time deposits, savings, and FX demand deposits. M1 on the other hand, grew stronger in Feb-22 by +18.3% YoY (55.7% share to M2) (prev: +17.1% YoY). Based on the factors affecting money supply, M2 development in Feb-22 was in line with continued acceleration of credit disbursement, amid slowdown in Central Government financial expansion and net foreign assets. As of Feb-22, credit grew by +5.9% YoY, stronger than the previous +5.4% YoY growth. This was in-line with increase in productive and consumptive credit distribution.

Calendar

March 2022

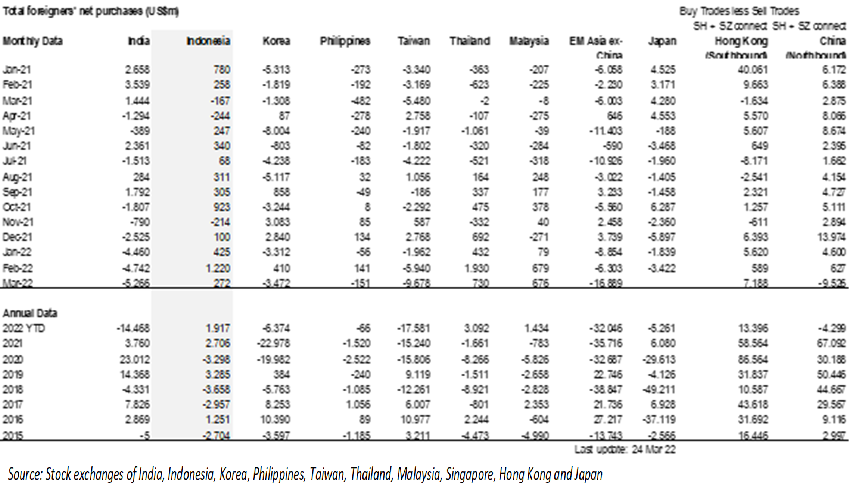

EM Equities Net Foreign Flow