09 May 2022

Weekly Market Review (09 May 2022) - What happened and What's Next

Market update

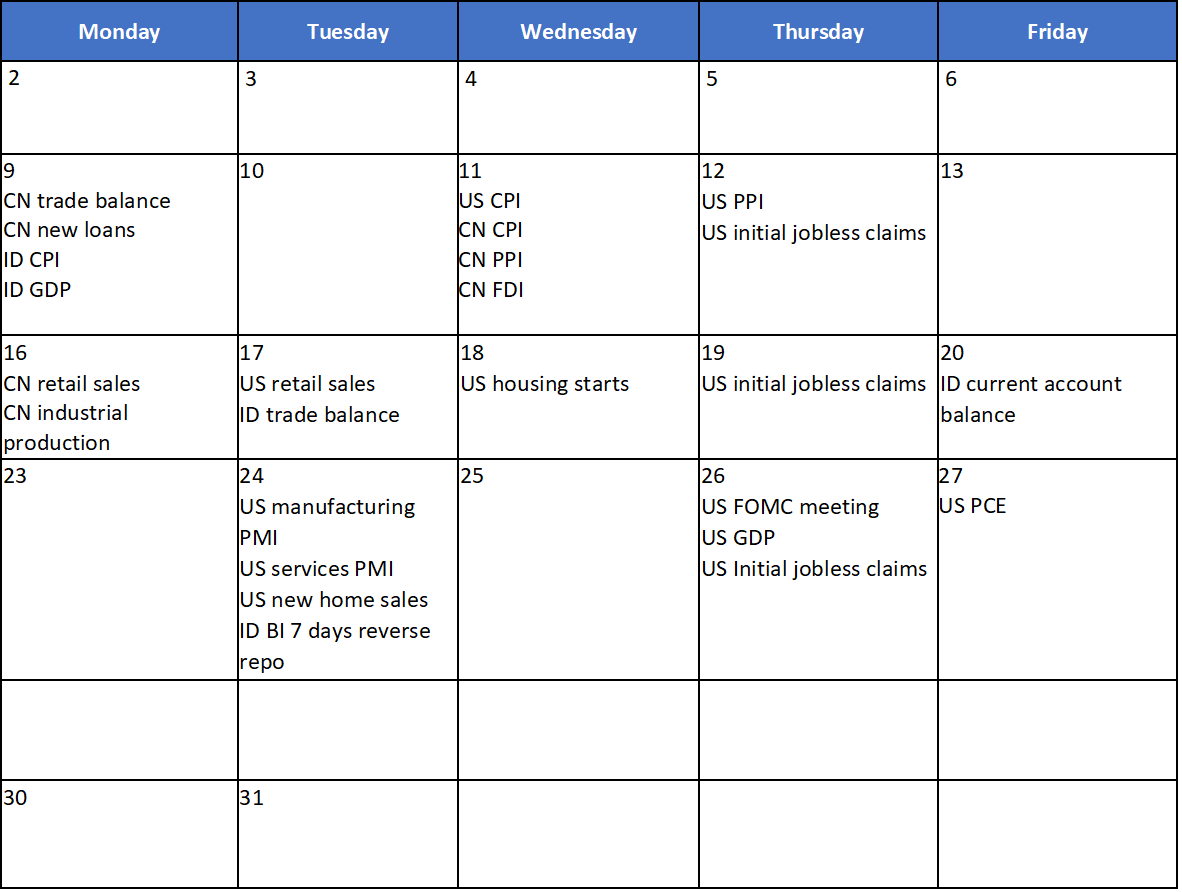

- Major global indexes booked another losses last Friday with S&P and Dow Jones each down by -3.9% and -2.8% WoW respectively. Gains in the earlier week was wiped out as investors worried about stagflation. The FOMC increased of 50bps was largely as expected. However, the Fed Chair Jerome Powell pushed against the idea of rate hike more than 50 bps. Powell made a remark that a large interest rate hike of 75 basis points was not being actively considered by the Fed. Investors were concerned the central bank may not be doing enough to bring inflation under control amidst slowdown in economy. In data, US payrolls report was mixed (headline beat on NFP at 428K, but slower than expected wages growth and participation rate). Meanwhile, JCI was closed flat on Thursday, 28th of April, prior to the Eid al-Fitr long holiday. The main outperformers were energy and industrial sector, inched up by +4.6% and +4.5% WoW respectively. On the other hand, transportation & logistic (-2.9% WoW) and technology sector (-2.7% WoW) were the underperformers. News flows to be watched within this week: US CPI, US initial jobless claims, CN CPI and CN FDI.

- Rupiah depreciated by -1% WoW to IDR 14,497, in line with other EM currencies' performance. Meanwhile, DXY strengthened by +2.4% WoW to 103.6.

- INDOGB yields continued to rose with shorter tenor hit the most. Along the curve, yields rose by 2-30bps, with yield of > 5yr up by almost 30bps. INDOGBs sell off on the back of higher UST that traded around 2.95%. Movement was mild on the longer tenor with 10yr unchanged from prior week at 6.98%.

- No auction was scheduled on Tuesday and next Conventional auction will be on 10th May with target issuance of IDR 20tn.

- Based on DMO data, foreign ownership as of 27th Apr was reported at IDR 831.87tn or 17.11%

- Treasury yields rose as market digested weaker labor market data and Fed decided to increase rates and weaker labor market data. The Fed also outlined its plans to start reducing its balance sheet in June. 10yr UST hit 3% after the meeting amid concerns of rising inflation and Fed’s more aggressive rate hike cycle could slow economic growth. By the end of the week, 10yr UST was reported at 3.12% (+25bps WoW)

Global news

- US new home sales in Mar-22 was at 763k, fell below expectation of 770k and declined from prior month of 835k.

- US initial jobless claims recorded 180k last week in line with consensus number but declined from prior's week figure at 185k.

- US nonfarm payroll in Apr-22 arrived at 428k vs consensus's expectation of 400k and identical to Mar-22 number. Meanwhile, wages growth is at 0.3%, slightly lower than consensus' expectation of 0.4%.

- China’s official manufacturing PMI data dropped to 47.4 in Apr-22 (below consensus: 47.3) from 49.5 in Mar-22 while non-manufacturing PMI slumped to 41.9 in Apr-22 (much below consensus 46.0) from 48.4 in Mar-22, mainly due to stringent COVID restrictions.

Domestic News

- The government issued the detailed regulation of the cooking oil and cooking oil raw material export ban, through the Regulation of the Minister of Trade (Kemendag) No. 22 2022, concerning the Temporary Prohibition of Exports, which include the Crude Palm Oil, Refined, Bleached and Deodorized Palm Oil, Refined, Bleached and Deodorized palm olein and Used Cooking Oil. However, exporters who have received an export permit before April 27, 2022, can still carry out their exports. The export ban takes effect from April 28, 2022 until the price of bulk cooking oil can reach IDR 14,000 per liter.

- Indonesia's 1Q22 GDP arrived at 5.01%, better than consensus expectation of 4.95% and similar to previous quarter's at 5.02%.

Calendar

May 2022

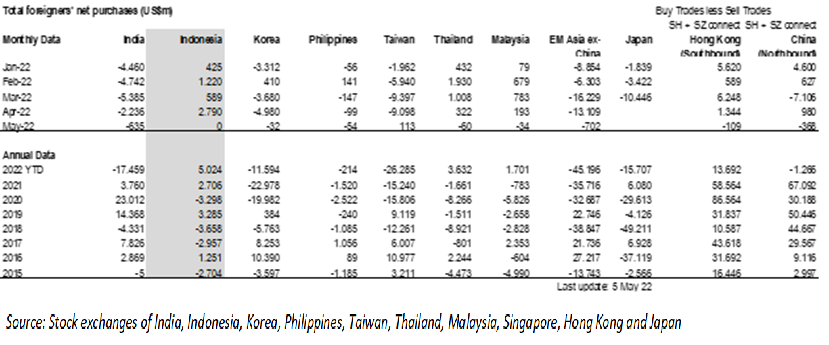

EM Equities Net Foreign Flow