17 May 2022

Weekly Market Review (17 May 2022) - What happened and What's Next

Market update

- Major global indexes booked another losses last Friday with S&P and MSCI Asia ex-Japan down by -2.4% WoW, despite a surge in the US stocks on Friday amid some easing in US long-bond yields. The widely watched core CPI m-m came higher than consensus, disappointing market participants who were looking for an ‘all-clear’ sign on inflation concerns. Powell, in an interview, sounded pessimistic about the outlook for a “soft landing” calling it “quite challenging to accomplish”; Governor Waller stated that Fed can front-load rate hikes without having a significant impact on unemployment; New York Fed's Williams (voter) said higher rates will cool demand in rate-sensitive sectors to better align with supply and align job opportunities with labour supply; Cleveland’s Mester (voter) believes the Fed will need to move beyond neutral to cut inflation and that she is ok with several more 50bp hikes. Inflation in Asia ex-Japan was relatively benign through most of 2020-21, but has already breached the Central Bank (CB) targets in India, South Korea, Thailand, and Singapore and is putting pressure on CBs to contemplate rate hikes. India's decision to ban wheat exports is likely to add to growing food inflation risks in Asia. In China, the impact of lockdowns is also impacting the inflation outlook, as inflation readings came higher than market expectations. In China, data was generally weak. Export growth (in USD terms) fell slightly more than estimates in April. April credit data came far below consensus estimates too due to worsening credit demand, extensive Covid-19 lockdowns, restricted mobility, logistical disruptions and a deteriorating property market. On domestic, JCI closed -8.7% WoW after the Eid al-Fitr long holiday. The main outperformers were Transportation and Consumer sectors, inched up by +2.0% and +1.6% WoW, respectively. On the other hand, Technology sector was the main underperformer declining by -19.11% WoW. News flows to be watched within this week: US retail sales, housing starts, initial jobless claims, and Indonesia current account balance.

- Rupiah depreciated by -0.8% WoW to IDR 14,613, in line with other EM currencies' performance. Meanwhile, DXY strengthened by +0.9% WoW to 104.6.

- A sharp sell-off in INDOGB as market reopen from the long Mubarak holiday. Yields along the curve were up by 20-60bps, where 7yr has the biggest increase of 60bps to 7.49%. Risk off sentiment from offshore following the long holiday sent the 10yr to 7.36% (+40bps WoW).

- Total incoming bids in Tuesday bond auction dropped significantly reaching only IDR 19.7tn compared to previous incoming bids of IDR 40.3tn. Compared to the previous auction, demand for all bond series fell especially in the SPN series reporting only IDR 6.16tn (vs. IDR 24tn average bid YTD). Meanwhile solid demand still seen in 10yr reaching IDR 7.8tn (vs. IDR 9.2tn in previous auction). The government finally issued only IDR 7.7tn in regular auction and accepted all bids of IDR 2.225tn in GSO. Both included the government has issued IDR 9.985tn which still lower than initial target of IDR 20tn.

- Based on DMO data, foreign ownership as of 12th May was reported at IDR 813.21tn or 16.70%

- Treasury yields fell below 3% after key inflation data showed a faster than expected rise in prices but lower than March reading. Markets turn to safety assets this week as stocks have plummeted due to concerns over rising interest rates and economic slowdown. By the end of last week, 10y UST was reported at 2.93% (-19bps WoW).

Global news

- US CPI in April 2022 recorded +8.3% YoY, above consensus estimate of +8.1% YoY.

- US PPI in April 2022 recorded +11% YoY, above consensus estimate of +10.7% YoY.

- US initial jobless claims recorded 203k, worse than consensus estimate of 193k.

- China trade balance in April 2022 recorded USD 51bn, below consensus estimate of USD 53.5bn.

- China PPI in April 2022 recorded +8% YoY, above consensus estimate of +7.8% YoY.

- China CPI in April 2022 recorded +2.1%, above consensus estimate of +1.8% YoY.

- China new CNY loans in April 2022 recorded CNY 645bn, below consensus estimate of CNY 1,530bn.

- China industrial production in April 2022 recorded -2.9% YoY, below consensus estimate of +0.5% YoY.

- China retail sales in April 2022 recorded -11.1%, below consensus estimate of -6.6% YoY.

Domestic News

- Indonesia GDP in 1Q22 recorded +5.01% YoY, above consensus estimate of +4.95% YoY.

- Indonesia CPI in April 2022 recorded +3.47% YoY, above consensus estimate of +3.32% YoY.

- Indonesia foreign reserves in April 2022 recorded USD 135.7bn.

- Indonesia trade balance in April 2022 recorded USD 7.6bn surplus, above consensus estimate of USD 4bn surplus.

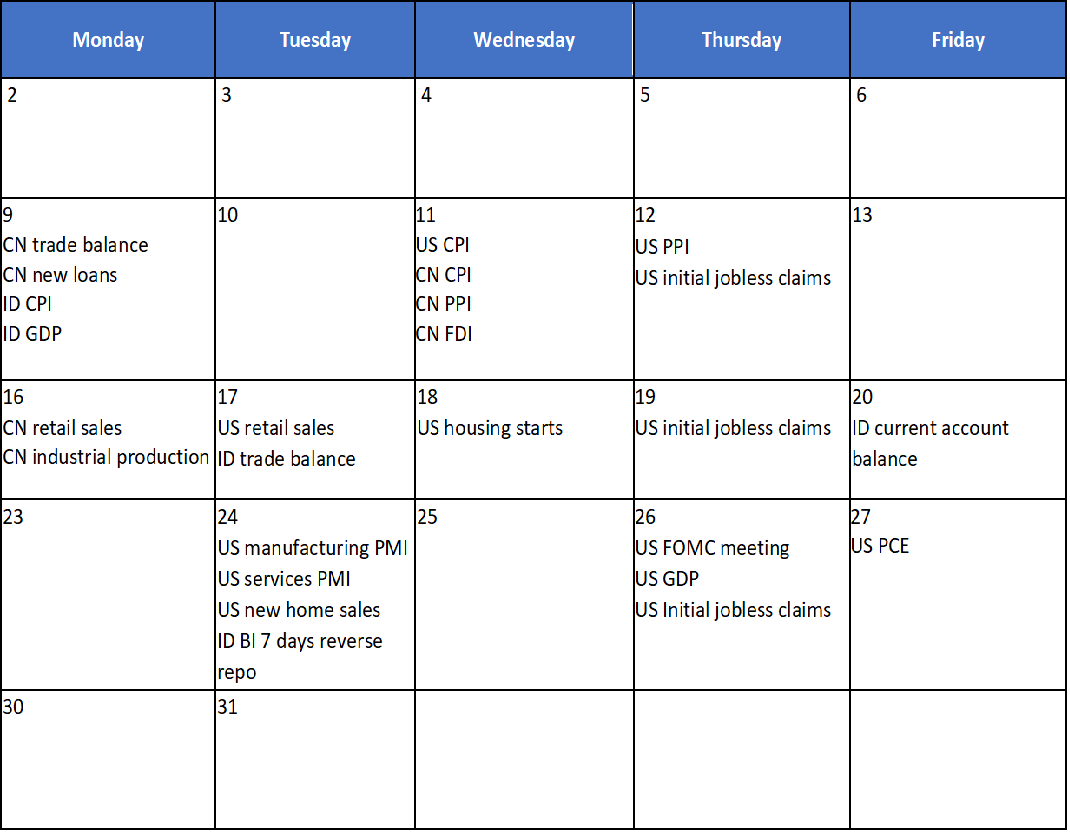

Calendar

May 2022

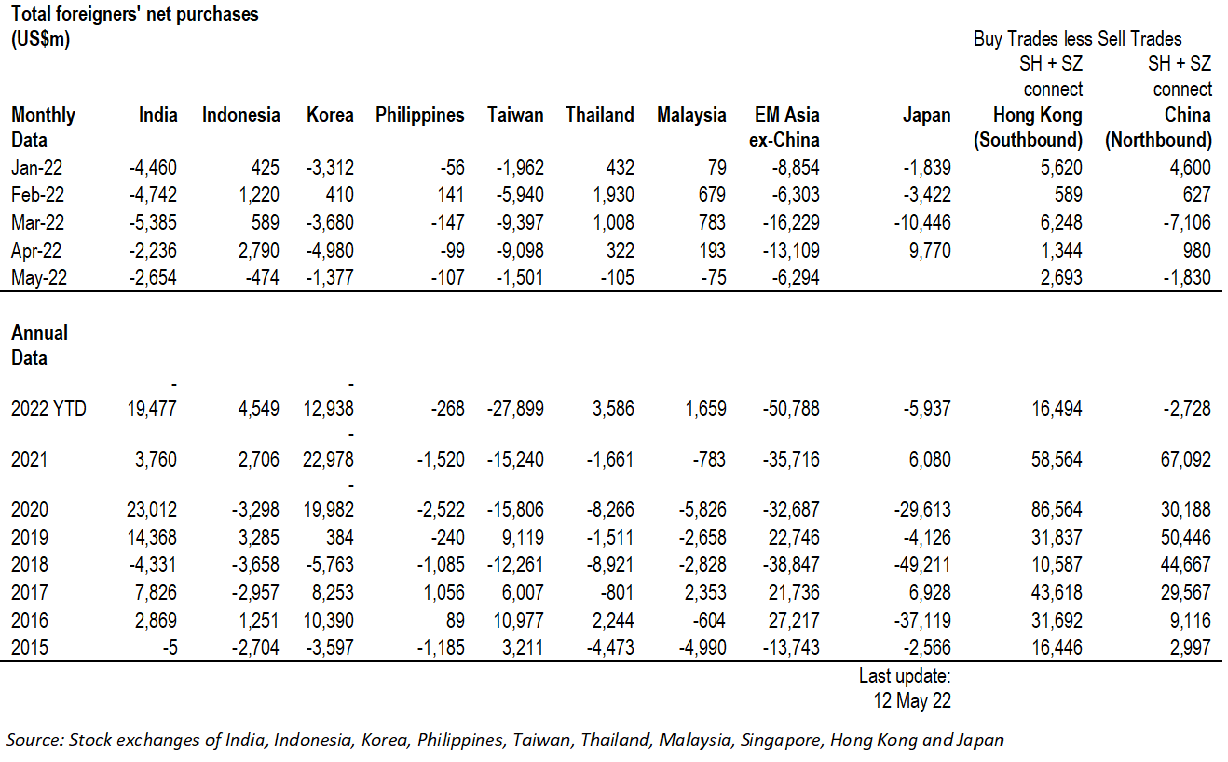

EM Equities Net Foreign Flow