30 May 2022

Weekly Market Review (30 May 2022) - What happened and What's Next

Market update

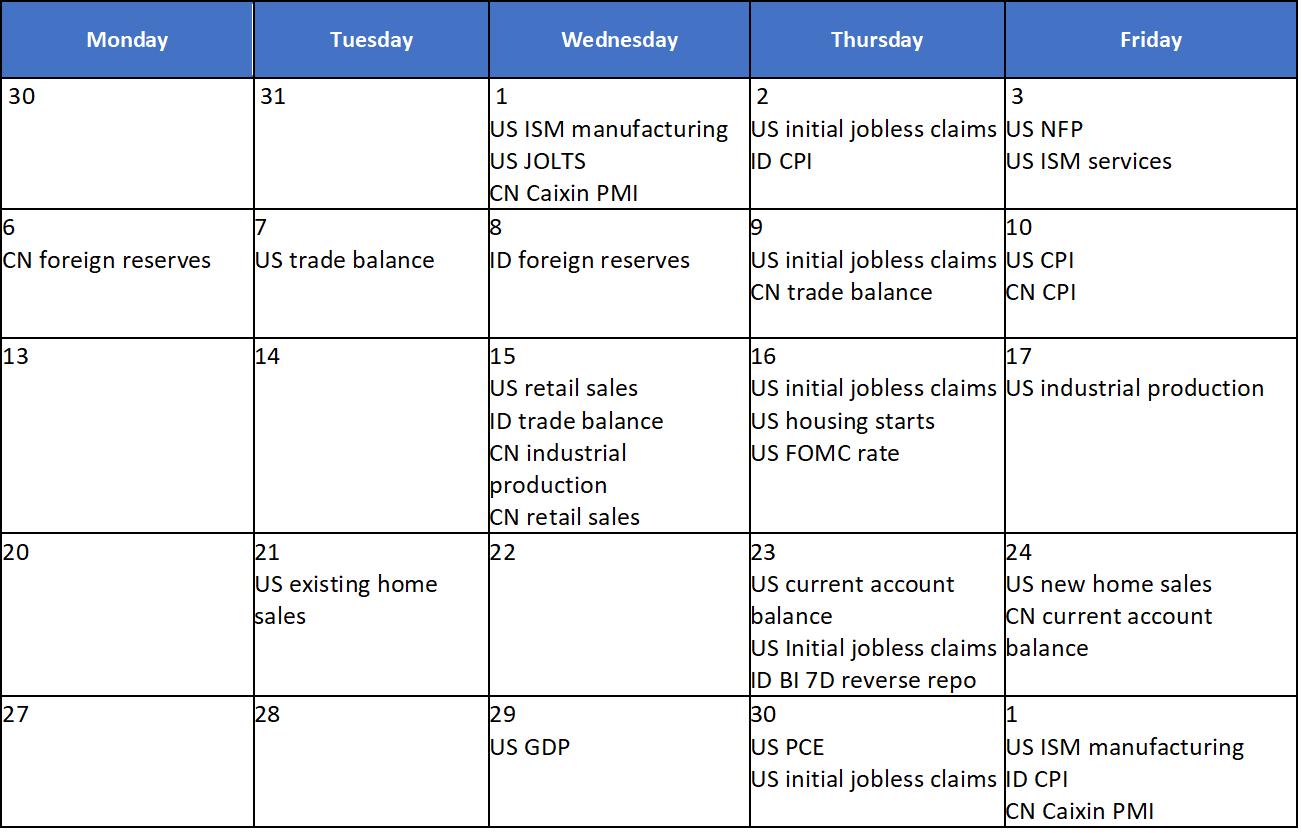

- Most equity indexes were closed higher last week with US indexes recovered some of the previous weeks' losses (S&P and DJI up by +2.0% and +1.6% WoW respectively) post the release of inflation data. US PCE index in Apr-22 rose just 0.2% MoM, the smallest monthly increase in a year and a half due largely to a decline in gas prices. The data sends signal that inflation may have peaked, hence expectations of Fed hawkishness have eased. In addition, strong retail and housing earnings also provided support to the indexes. On domestic side, JCI continued to book a gain of +1.6% WoW. Transportation & logistic sector was the main outperformer, increased significantly by +11.3% WoW. Meanwhile, technology was the most underperformed sector, down by -1.7% WoW. News flows to be watched within this week: US ISM manufacturing, US JOLTS, US initial jobless claims, US NFP, US ISM services, CN Caixin PMI and ID CPI.

- Rupiah strengthened by +0.5% WoW to IDR 14,557, largely in line with other EM currencies. Meanwhile, DXY weakened by -1.4% WoW to 101.7.

- Yields along the curve fell by 3-23 bps on the back of foreign inflows. A combination of softer USD/IDR, turnaround of US Rates and no hike by BI gave relief to the market. By the end of last week, 10yr yield was reported at 7.06% (-9bps WoW).

- Total incoming bids rebounded to IDR 39.41tn compared to IDR 19.74tn in the previous auction. Almost all bond series bids went up with biggest demand was seen in SPN 3mo (reached IDR 10.6tn). Solid demand was also present in the 10yr series with bids amounting to IDR 12.4tn, much higher compares to previous bid of IDR 7.9tn. The government finally issued IDR 20tn as targeted.

- The government successfully issued USD 3.5bn global sukuk, marked the biggest sukuk issuance in the history. There were two series offerings: 5 and 10yr with coupon of 4.4% and 4.7% respectively. Total order booked was reported at USD 10.8bn or 3.3x target.

- Based on DMO data, foreign ownership as of 24th May was reported at IDR 789.13tn or 16.47%.

- US Treasury yields continued to fall as fears over the Fed’s plans to aggressively hike interest rates appeared to ease and key inflation reading showed a slowing rise in prices. 10yr UST was reported at 2.74% (-4bps WoW).

Global news

- US manufacturing PMI was at 57.5 in May-22, in line with consensus but declined from prior's figure of 59.2. Meanwhile, US services PMI was at 53.5 lower than expectation of 55.0 and prior's figure of 55.6.

- US initial jobless claims recorded 210k, lower than consensus estimate of 215k and prior 218k.

- US PCE inflation in Apr-22 was up by +0.2% MoM from +0.9% MoM in the previous month. While core PCE was up +0.3% MoM, in line with consensus expectation and prior's figure.

- U Mich consumer sentiment index in May-22 was at 58.4, slightly lower than expectation and previous month's number of 59.1.

Domestic News

- MoF Sri Mulyani asked the entire ministries and institutions to cut spending for the 2022 budget year amounting to Rp24.5 tn. Note that as of 20 May-22, the budget for goods and capital expenditures that has not been realized nor contracted was amounting to IDR 227.2tn.

- Jakarta Governor Anies Baswedan has issued a new regulation as the capital is now under the least restrictive COVID-19 curbs or PPKM Level 1. In the new policy, restaurants or cafes that are open at night are allowed to operate until 02:00 a.m. Meanwhile, restaurants or cafes that are open in the morning, such as food stalls or warteg, street vendors, and others, can only operate until 10:00 p.m. with full capacity.

- Bank Indonesia maintained the benchmark rate-BI7DRR at 3.50%, also with lending facility and deposit facility rates stable at 4.25% and 2.75%, respectively. While keeping its policy rate unchanged, BI unveiled faster hikes in the reserve requirement ratio (RRR), which will be raised from the current 5% to 6% in June (as planned) to 7.5% in July and 9% in September (vs. original plan to raise to 6.5% in Sep).

Calendar

June 2022

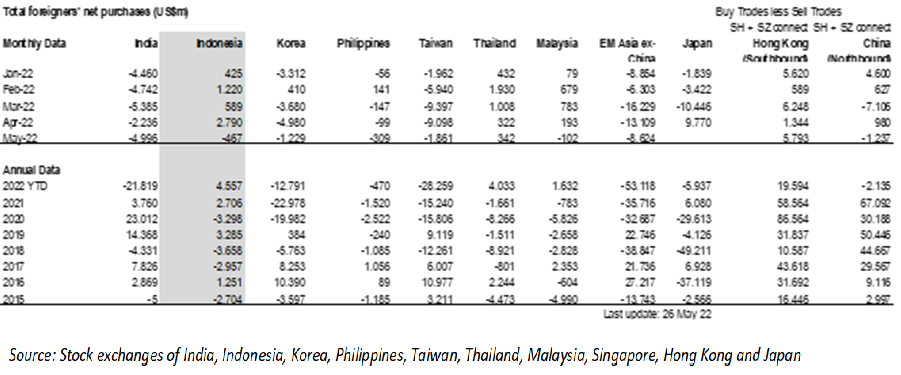

EM Equities Net Foreign Flow