18 July 2022

Weekly Market Review (18 July 2022) - What happened and What's Next

Market update

- Global indexes were back in the red again last week with S&P 500 down by -0.9% WoW and MSCI Asia ex-Japan down by -3.7% WoW, as inflation came in higher than expected on the previous week. However, Friday’s economic data, which included somewhat improving or steady inflation expectations from the University of Michigan’s consumer survey, prompted traders to lower their expectations for a 100 basis point hike in less than two weeks. As of Friday, traders were pricing in a 31% chance of a 100 basis points move on July 27, down significantly from Wednesday, and a 69% likelihood of a 75 basis point hike. On domestic side, JCI closed lower -1.3% WoW. The worst performer sector was Technology sector, down by -1.9% WoW. While Transportation sector was the best performing sector, up by +1.9% WoW. News flows to be watched within this week: US initial jobless claims and BI 7-day reverse repo decision.

- Rupiah continued its weakening trend, down -0.1% WoW to IDR 14,993, outperforming other EM currencies. In contrast, DXY strengthened by 1% WoW to 108.1.

- INDOGBs were traded sideways ending the week with 2-24bps lower in yields. BI started adjusting RR auction rates, for instance 1m RR average rates have gone up to 3.50% compared to 3.20% in prior weeks. By the end of last week, 10yr INDOGB was reported at 7.38% (+13bps Wow).

- Total incoming bids in Tuesday’s sukuk auction lowered slightly from the previous sukuk auction reaching IDR 15.8tn. The government decided to issue IDR 6tn or lower than initial target of IDR 7tn. This is in line with government projection for budget deficit outlook at -3.9% of GDP compared to -4.5% of GDP.

- Based on DMO data, foreign ownership as of 14th July was reported at IDR 764.06tn or 15.65%.

- US Treasury yields rose with closely watched 2yr and 10yr yield curve remained inverted, and the inversion between those rates narrowed. Markets expect that the Fed would hike by 100bps at July’s meeting. The inversion of the 2yr and 10yr UST shrank to as low as 15bps from 27.6bps the most since 2000. By the end of last week, 10yr UST was reported at 2.93% (-6bps WoW).

Global news

- US CPI in June 2022 reported +9.1% YoY, above consensus estimate of +8.8% YoY.

- US PPI in June 2022 reported +1.1% YoY, above consensus estimate of +0.8% YoY.

- US initial jobless claims reported 244k, above consensus estimate of 235k.

- US retail sales in June 2022 reported +1% MoM, in-line with consensus estimate.

- US industrial production in June 2022 reported -0.2% MoM, below consensus estimate of +0.1% MoM.

- China PPI in June 2022 reported +6.1% YoY, in-line with consensus estimate.

- China CPI in June 2022 reported +2.5% YoY, in-line with consensus estimate.

- China new RMB loans in June 2022 reported RMB 2.8tn, above consensus estimate of RMB 2.4tn.

- China trade balance in June 2022 reported USD 97.9bn, above consensus estimate of USD 76.8bn.

- China 2Q22 GDP reported +0.4% YoY, below consensus estimate of +1.2% YoY.

- China industrial production in June 2022 reported +3.9% YoY, in-line with consensus estimate.

- China retail sales in June 2022 reported +3.1% YoY, above consensus estimate of +0.3% YoY.

- China surveyed jobless rate in June 2022 reported 5.5%, better than consensus estimate of 5.7%.

Domestic News

- Indonesia trade balance in June 2022 reported USD 5.1bn surplus, above consensus estimate of USD 3.5bn surplus.

- The International Monetary Fund (IMF) estimates that Indonesia's economic growth is still quite solid and able to reach around 5% in 2022, even though it is faced with the risk of escalating inflation.

- The State Administrative Court (PTUN) has revoked the revision of DKI Jakarta 2022 Provincial Minimum Wage (UMP) for 2022. This means that the minimum wage has changed from the previous IDR 4.64mn to IDR 4.57mn for this year, still up +0.85% from the 2021 UMP.

Calendar

July

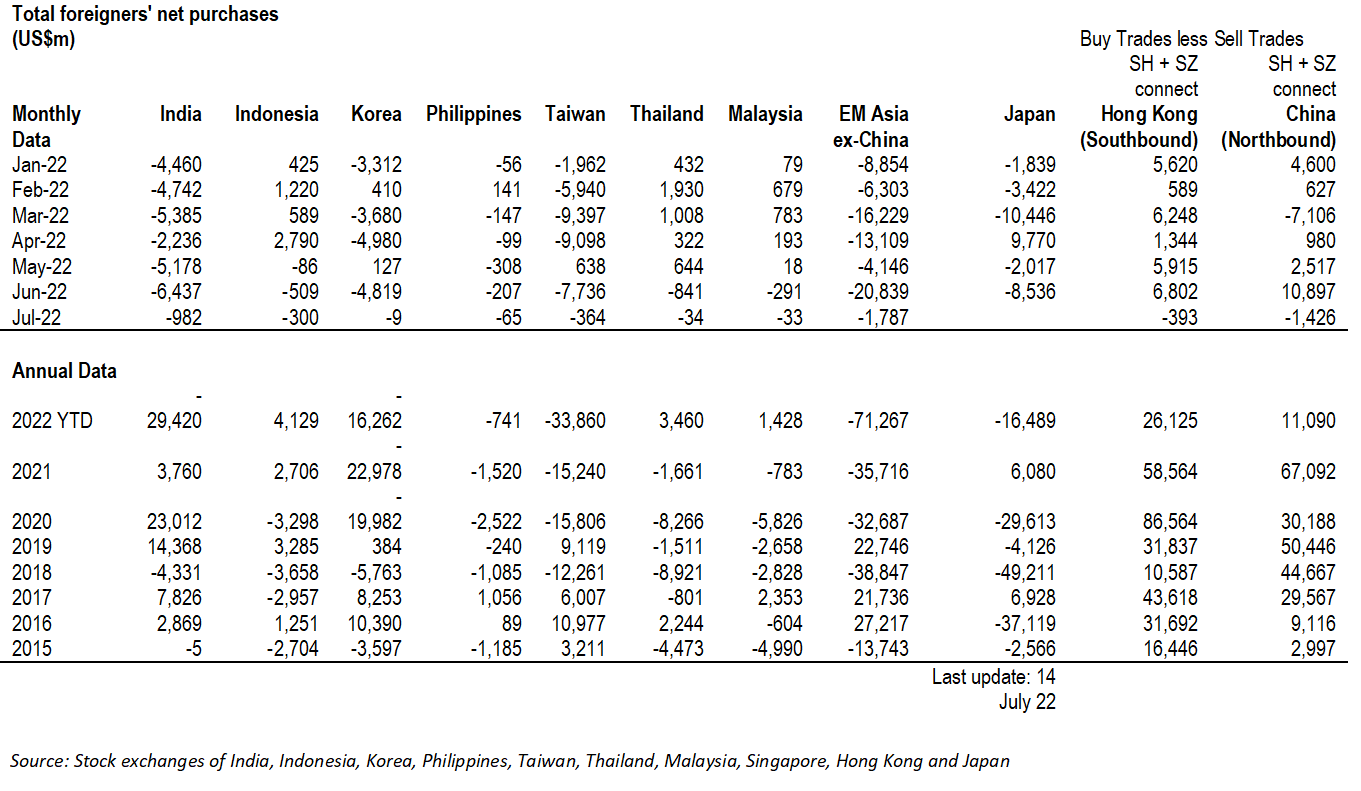

EM Equities Net Foreign Flow