19 September 2022

Weekly Market Review (19 Sept 2022) - What happened and What's Next

Market update

- Global indexes were hammered last week with S&P 500 down by -4.8% WoW and MSCI Asia ex-Japan down by -2.7% WoW, on the back of higher than estimated August inflation number. August core CPI reported +0.57%MoM, above consensus expectation of +0.3% MoM, upended the market narrative that slowing inflation would allow the Fed to imminently slow and then pause rate hikes. The terminal policy rate repriced from around 3.75% to close to the 4.25-4.5% range. On the other hand, The University of Michigan consumer sentiment index increased for the third month in a row from 58.2 in August to 59.5 in September, mainly due to improvements in the consumer expectations index. This eases the probability of hiking 100bps on the upcoming September FOMC meeting. On the domestic side, JCI declined by -1.0% WoW. Property sector was the main outperformer, up by +2.9% WoW. Meanwhile, Basic Material sector was the main underperformer down by -2.4% WoW. News flows to be watched within this week: US FOMC, PMI, home sales, initial jobless claims; China loan prime rate; and BI 7-day reverse repo rate decision.

- Rupiah depreciated by 0.8% WoW to IDR 14,953, in-line with other EM currencies. DXY strengthened by 0.7% WoW to 109.76.

- INDOGB traded sideways with a tendency to weaken on this weeks’ final trading day. By the end of the week, 10yr INDOGB was reported at 7.22% (+5bps WoW).

- Total incoming bids on Tuesday’s conventional auction rebounded to IDR 52.1tn compared to IDR 47.2tn in previous auction. Total incoming bids were driven by medium-term tenors 10yr was the most attractive series with bids of IDR 14.9tn. It was followed by the new series FR98 (15yr) and FR95 (5.9yr) which reported bids of IDR 11.2tn and IDR 8.9tn respectively. Government finally issue IDR 19tn as targeted.

- Based on DMO data, foreign ownership as of 15th Sept was reported at IDR 750.20tn or 14.93%.

- US Treasury yields rose, with 2yr tenor tops 3.85% on higher Fed rate hike expectations. Yields continued to rise on the view that policy makers will keep hiking rates and leave them higher for longer. Markets expect the Fed to raise its benchmark rate by at least 75bps on the upcoming Fed meetings. By the end of the week, 10yr UST was reported at 3.45% (+12bps WoW).

Global news

- US CPI in Aug 2022 reported +8.3% YoY, above consensus estimate of +8.1% YoY.

- US PPI in Aug 2022 reported +8.7% YoY, below consensus estimate of +8.8% YoY.

- US initial jobless claims reported 213k, better than consensus estimate of 227k.

- US retail sales in Aug 2022 reported +0.3% MoM, above consensus estimate of -0.1% MoM.

- US industrial production in Aug 2022 reported -0.2% MoM, below consensus estimate of 0%.

- China industrial production in Aug 2022 reported +4.2% YoY, above consensus estimate of +3.8% YoY.

- China retail sales in Aug 2022 reported +5.4% YoY, above consensus estimate of +3.3% YoY.

- China surveyed jobless rate in Aug 2022 reported 5.3%, better than consensus estimate of 5.4%.

Domestic News

- Indonesia trade balance in Aug 2022 reported USD 5.8bn surplus, above consensus estimate of USD 4bn.

- Bank Indonesia has tightened the rupiah Statutory Reserves policy to absorb excess liquidity. Financial Services Authority noted that third party funds experienced a slowdown compared to 6M22 but continued to grow by 8.5% YoY in 7M22.

- The peak of inflation is predicted to occur in January 2023, which reflects the impact of price pressures in the last 4 months of this year due to the food crisis and rising fuel prices. The Bank Indonesia survey noted that general price expectations on Jan-23 reached 144.7, the highest since Feb-21 which reached 156.4.

- Following the increase in ride-hailing rates, ride-hailing drivers rejected the zoning scheme, claiming that the operational burden of drivers in each city and province is different. The drivers are also prefer app fee not to exceed 10% (currently at 15%).

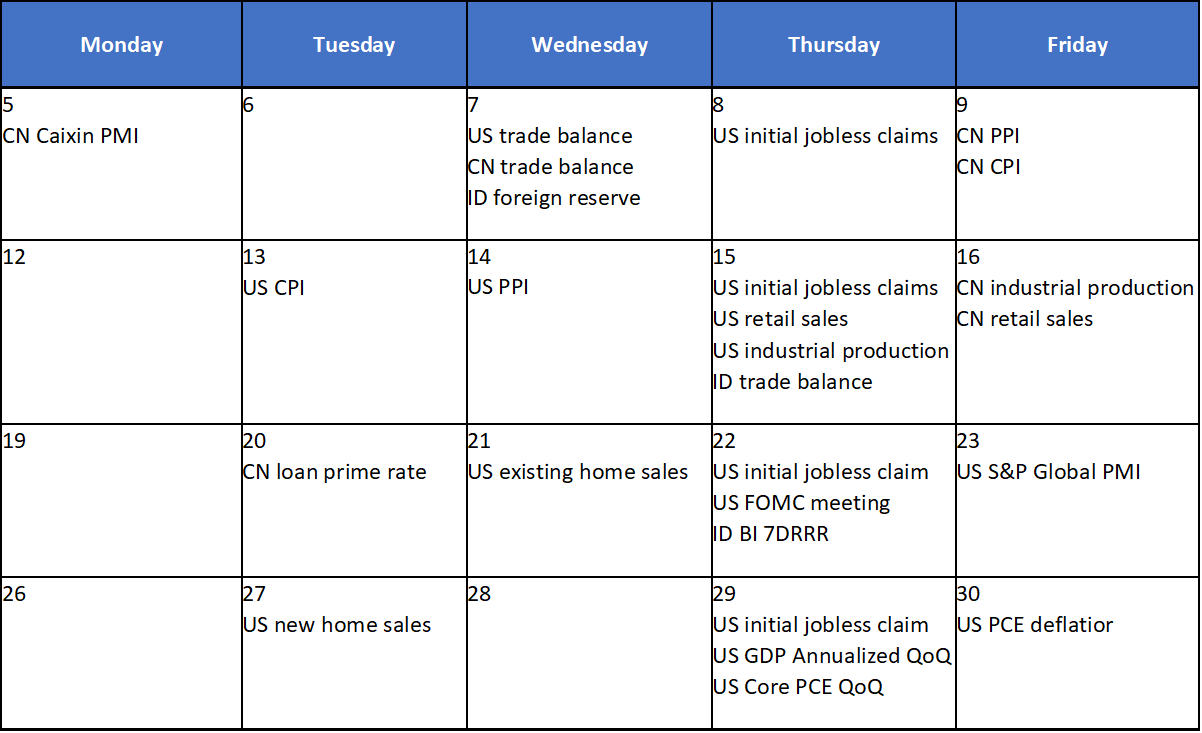

Calendar

September 2022

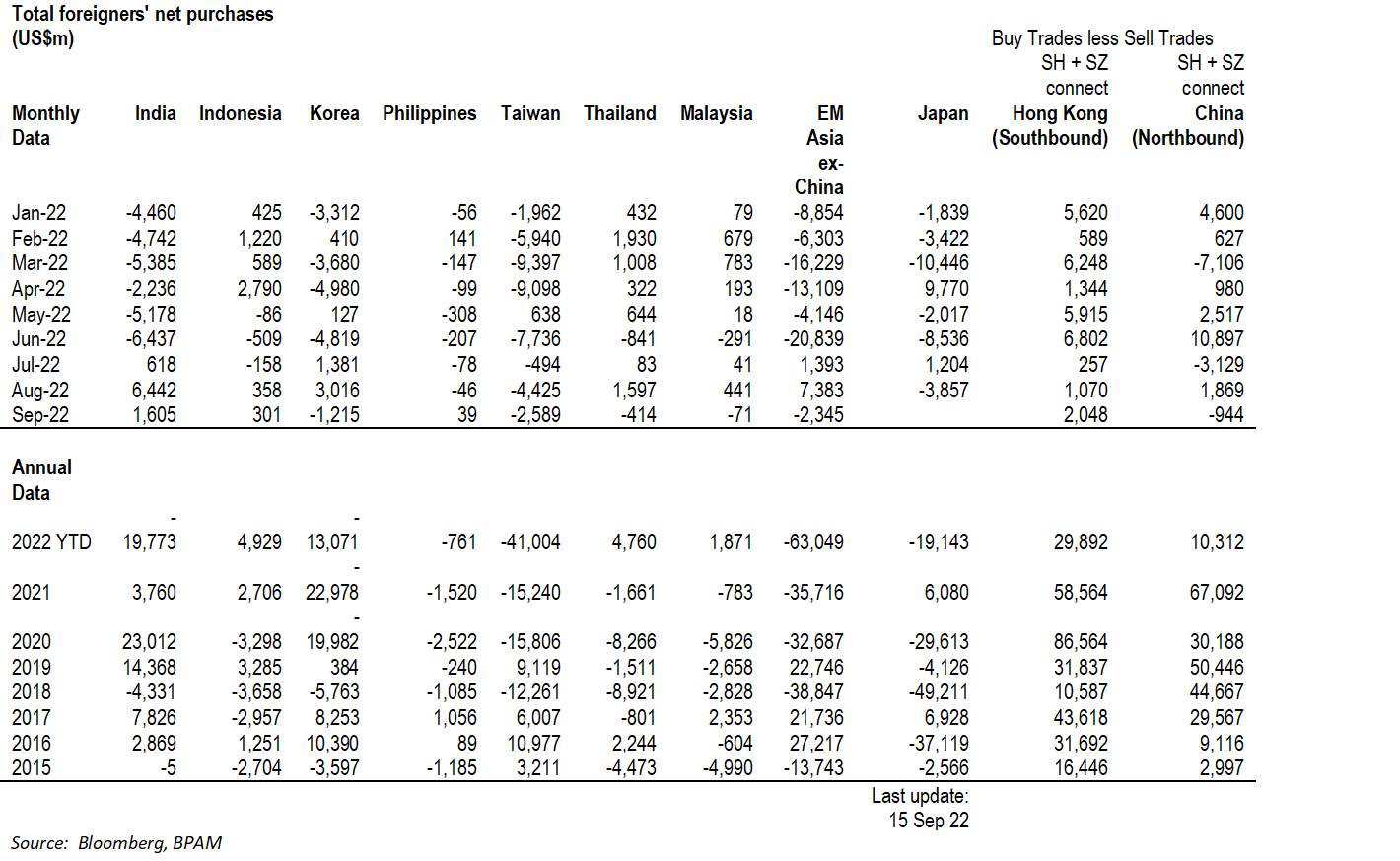

EM Equities Net Foreign Flow