10 October 2022

Weekly Market Review (10 Oct 2022) - What happened and What's Next

Market update

- Global indexes regained traction last week with S&P 500 up by +1.5% WoW and MSCI Asia ex-Japan up by +2.0% WoW as softer US data and a smaller hike by the RBA led to hopes that a Fed pause may be around the corner, on top of the oversold conditions and depressed sentiment. However, the Fed speakers this past week were aggressive to push back against the idea of rate cuts in 2023, whilst reasonably strong US payrolls report on Friday reinforced market expectations that another 75bp hike is likely in Nov 2022, throwing cold water on the idea of a Fed pivot. Adding to the negative sentiment, the US commerce department announced chip export restrictions that will make it harder for the Chinese companies to obtain US technology used for advanced computing and artificial intelligence applications. On oil, OPEC+ has announced 2mn bbl/day production cut starting Nov 2022, higher than the planned August 2022 level. This move caused another surge in oil prices this past week, and thus raised market concerns that commodities' inflation might become more long-lasting and high energy prices may also weigh on economic growth rates going forward. On the domestic side, JCI booked a loss of -0.2% WoW with Energy sector as the main outperformer up by +6% WoW. On the other hand, the main underperformer was Healthcare sector, down by -2.8% WoW. News flow to be watched within this week: US CPI, retail sales, initial jobless claims, FOMC minutes; China CPI, trade balance; Indonesia trade balance.

- Rupiah continued to depreciate by 0.2% WoW to IDR 15,251, in-line with other EM currencies. DXY strengthened by +0.6% WoW to 112.8.

- INDOGB had a small rally, especially front end which yield decline by 4-14bps over the week. Front end yield seems supported as local onshore and offshore seen buying as 5yr decline the most by 14bps to 6.71%. Meanwhile 10yr was decline by 5bps to 7.24% by the end of the week. This move was mostly driven by lower global core rate while at the same time MOF released Q4 issuance calendar targeting IDR 75tn.

- Total incoming bids in the first Q4 Sukuk auction plunged to IDR 7.1tn much lower than previous incoming bids at IDR 17.1tn. The 11.4yr PBS29 was the biggest demand reaching IDR 2.6tn or 37% of total incoming bids. The government issued only IDR 0.7tn or much lower than initial target of IDR 5tn and the lowest issuance ever.

- US Treasury yields rose after solid report on the labour market put down hopes the Fed would alter its path of aggressive interest rate hikes as it seeks to combat inflation. Job growth eased slightly in September but remained robust, indicating that the economy was maintaining momentum despite higher interest rates. By the end of the week ,10yr UST was reported at 3.89% (+6bps WoW). Meanwhile the 2yr was at 4.30% (+8bps WoW), continued to invert with the 10yr.

Global news

- US ISM manufacturing in Sep 2022 recorded 50.9, below consensus estimate of 52.0.

- US ISM services in Sep 2022 recorded 56.7, above consensus estimate of 56.0.

- US ADP employment in Sep 2022 recorded 208k, above consensus estimate of 200k.

- US trade balance in Aug 2022 recorded USD 67.4bn deficit.

- US initial jobless claims recorded 219k, above consensus estimate of 204k.

- US non-farm payroll in Sep 2022 recorded 263k, above consensus estimate of 255k.

- US unemployment rate in Sep 2022 recorded 3.5%, below consensus estimate of 3.7%.

- China services PMI in Sep 2022 recorded 49.3, below consensus estimate of 54.4.

- China foreign reserves in Sep 2022 recorded USD 3,029bn, above consensus estimate of USD 2,998bn.

Domestic News

- Indonesia CPI in Sep 2022 recorded +5.95% YoY, below consensus estimate of +6.0% YoY. Core CPI in Sep 2022 recorded +3.21% YoY, below consensus estimate of +3.5% YoY.

- Indonesia foreign reserves in Sep 2022 recorded USD 130.8bn, lower than previous month of USD 132.2bn.

- Inflationary pressure is expected to ease into October 2022. Bank Indonesia estimates inflation in October to be 0.01% MoM.

- The Directorate General of Taxes of the Ministry of Finance will evaluate the plan to appoint local e-commerce companies as tax collectors, such as Tokopedia, Blibli or Bukalapak.

- Gov’t has agreed to return the Pre-Employment Card Program scheme to normal scheme in 2023 with amount received of IDR 4.2mn/person. Gov’t will also increase the budget by IDR 5tn with a target of 1.5mn people.

- Bank loans grew 10.62% YoY, while third party funds only grew 7.7% YoY in Aug-22, slowing from the previous month which recorded 8.59% YoY growth.

Calendar

October 2022

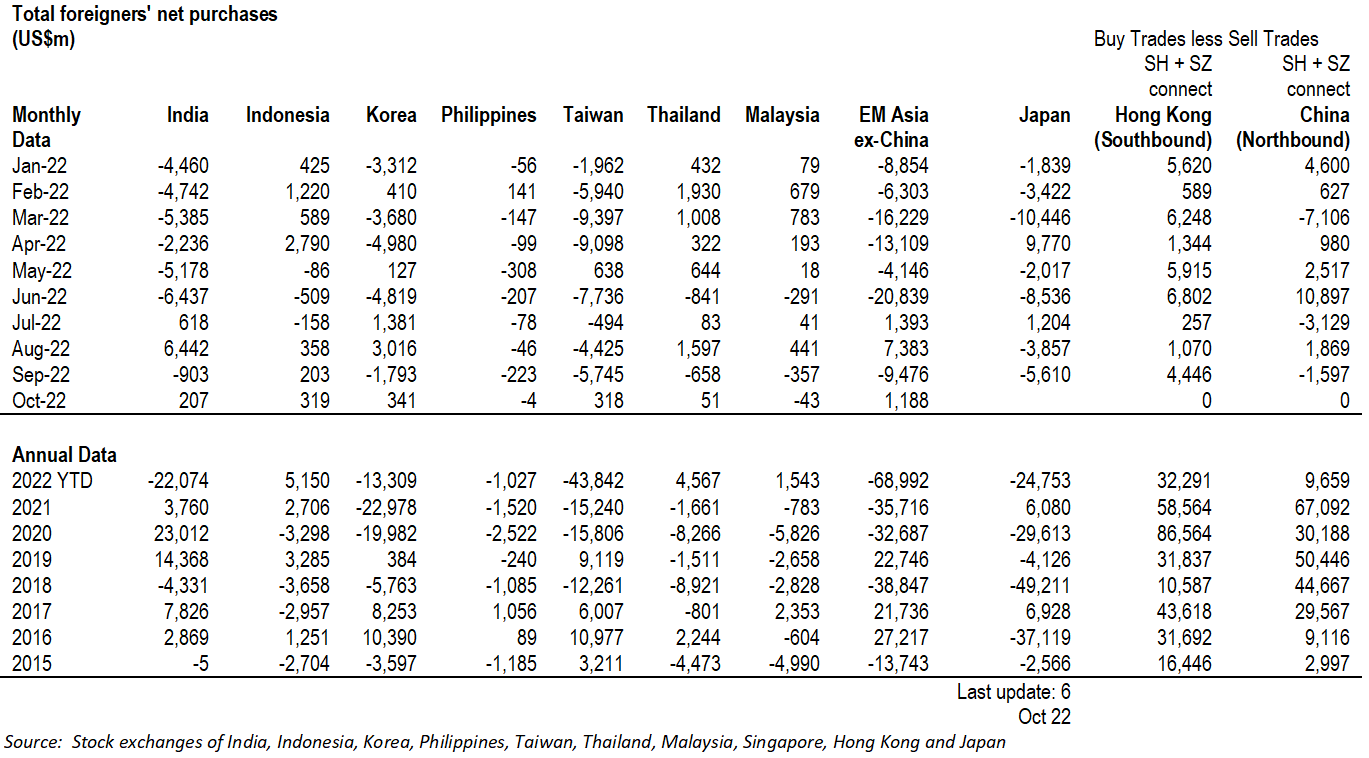

EM Equities Net Foreign Flow