01 July 2019

Weekly Market Review (01 July 2019) - What happened & What's next?

Market update

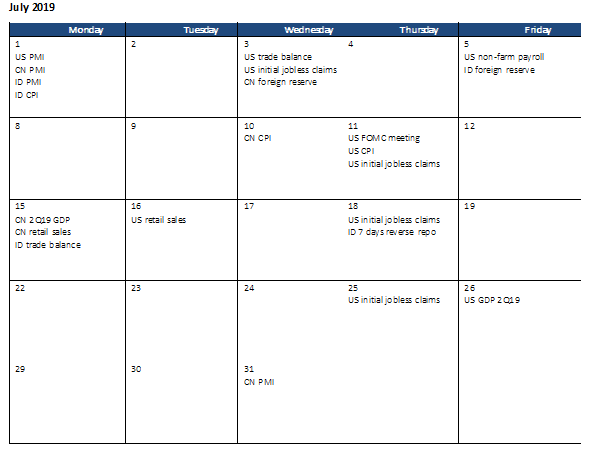

- Equity indexes were mixed last week ahead of G-20 meeting. During its Wednesday rate-setting meeting, the Fed signaling a willingness to trim rates as soon as the end of July 30-31 gathering to curb the effect of tariff clashes between US and China. Over the weekend, there are some improvement in trade war. Trump said he would let US firms sell high-tech equipment to Huawei and China would start buying large amounts of American farm products. While on domestic side, JCI closed higher last week, up +0.7% WoW. Mining was the most outperform sector (+4.4% WoW), followed by infra (+1.7% WoW) and financial sectors (+1.1% WoW). News flows to be watched within this week include US PMI, US trade balance, US initial jobless claims, US non-farm payroll, CN PMI, CN foreign reserve, ID PMI, ID CPI and ID foreign reserve.

- IDR appreciated to IDR14,126 (+0.2%WoW), in-line with the emerging markets. On the other hand, DXY fell to 96.1 (-0.1%WoW).

- After US-China trade talks continue at the G-20 meeting, bond market yield continue to rally by 5-13 bps. 10 year series decreased the most.

- Foreign investor reported net inflow of IDR 15.3tn over the week, mostly on 15 and 20 years series.

- US durable goods fell 1.3% May-19, adding concern about US slowing economy. This made 10 year US Treasury yield decreased from 2.07% to 2%.

Global news

- US core inflation (excluding food and energy) rose by +0.2% MoM in May-19. Hence, yearly inflation arrived at +1.6% YoY, still below the +2% target.

- US initial jobless claims in Jun-19 jumped to the highest level in almost 2 months, climbed by 10,000 to 227,000 last week. However, the 4 week average number remains low at 221,250.

- Russia and Saudi Arabia have agreed to extend the OPEC oil production cuts deal by another 6-9 months during their meeting at the G-20.

Domestic News

- The Constitutional Court rejected the lawsuit of candidate Prabowo Subianto. The General Election Commission had named President Jokowi and KH Ma’ruf Amin as the elected President and Vice President.

- Government tax revenue increased by +6.2% YoY in May-19 while expenditure rose by +9.8% YoY. Ministry of Finance stated that 2019 budget deficit target is still at 1.84% although achievement of 100% tax revenue target is challenging.

- Ministry of Finance will lower down income tax verse 22 for luxury property to be 1% from 5% previously.

- The 2020 Government Budget Plan (RAPBN) has allocated IDR 58.62 tn for electricity subsidies, down by IDR 6 tn from the previous year. The government will also apply tariff adjustments for electricity in the 900 VA group effective in 2020.

- Ministry of Finance discussed the possibility of lowering corporate income tax from 25% to 20%.

- Trade balance generated a surplus at USD 208mn in May-19 despite of festive season. Export decreased by -9% YoY while import fell deeper by -17.7% YoY. Although export aggregate prices dropped by -18.0% YoY (vs. -18.3% in Apr19), export volume did not deteriorate (flat growth, +10.9% YoY vs. 10.7% YoY in Apr19) mainly because of the rise in gas export volume. Whereas both import for O&G and non O&G has declined.

Calendar

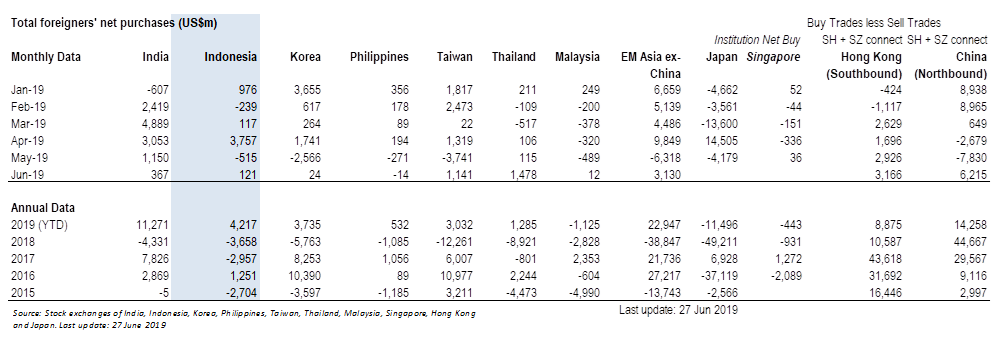

Foreign net purchases of Indonesia equities