08 July 2019

Weekly Market Review (08 July 2019) - What happened & What's next?

Market update

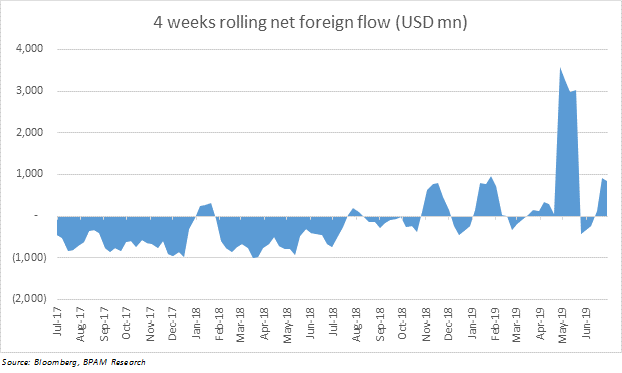

- Globally, markets turned to more positive mood in early last week, triggered by trade truce between US and China. However, until the ink on a deal is dry, uncertainty is almost certain to persist as talks could fail quickly and without prior warning. On domestic side, given a foreign inflow of USD69.3m, JCI gained +0.2%WoW to IDR6,373.5 by the end of the week. Miscellaneous industry was the worst performer with -2.6%WoW given weak auto sales data. Meanwhile, Basic Industry sector was the best performer (+2.8%WoW) last week due to rising chicken price. News flows to be watched within this week include China’s CPI; US FOMC meeting, PMI and initial jobless claim.

- IDR strengthened to IDR14,083 (+0.3%WoW), better than average emerging markets (-0.1%WoW). On the other hand, DXY rose to 97.3 (+1.2%WoW).

- Expectation on more easing from global central bank made bond market yield continue to rally by 10-21 bps. 20 year series decreased the most.

- Foreign investor reported net inflow of IDR2.3trn over the week, mostly on 20 years series.

- US economy unexpectedly added 224.000 jobs above consensus estimated and unemployment rate edged up to 3.7%. Strong jobs report made 10 year US Treasury yield increased from 2% to 2.04%

Global news

- US Initial Jobless Claims decreased by 8,000 to a seasonally adjusted 221,000 in the week ended June 29. Market had expected claims at 225,000.

- U.S. employers added 224,000 jobs compared to the street consensus of 164,000. The unemployment rate ticked up slightly over the previous month from 3.6% to 3.7% as did the underemployment rate from 7.1% to 7.2%. The report weakens the case for a rate cut but still leaves the door open as the health of the labor market was not cited as one of the economic pressures that could compel a cut.

- U.S. trade deficit in goods and services jumped 8.4%MoM in May to a seasonally adjusted USD55.52bn in May. The trade gap widened because of the biggest monthly rise in imports in more than four years along with moderate growth in exports amid a cooling global economy.

- US manufacturing PMI slipped to 51.7 in June from 52.1 in May. slightly higher than the 51.3 level expected by economists

- The China’s Caixin/Markit factory Purchasing Managers’ Index for June was 49.4 (vs 50.2 in May). It was below market’s expectation of 50.

- China’s FX reserves rose USD18.23bn in June to USD3.119trn, above market expectation that would rise USD2bn to USD3.103trn.

Domestic News

- CPI hike in Jun’19 rose 0.55%MoM/3.28% YoY (vs. consensus at 3.20%). In general, Jun19 inflation was low (average 2014-2018: 0.99% MoM) and, the highest contributor came from raw food (0.38ppt). Core inflation rose to +3.25% YoY from +3.12% in the prior month did not fully suggest that domestic demand has increased, but rather it was likely driven by external factors, shown by the rising gold price.

- Indonesian FX reserves grew by USD3.5bn in June to USD123.8bn - equivalent to 7.1 months of imports, with BI Governor noting the increase signaled Indonesia’s balance of payments position may continue to record a surplus in 2Q due to the larger surplus in the capital and financial accounts vs the deficit in the current account.

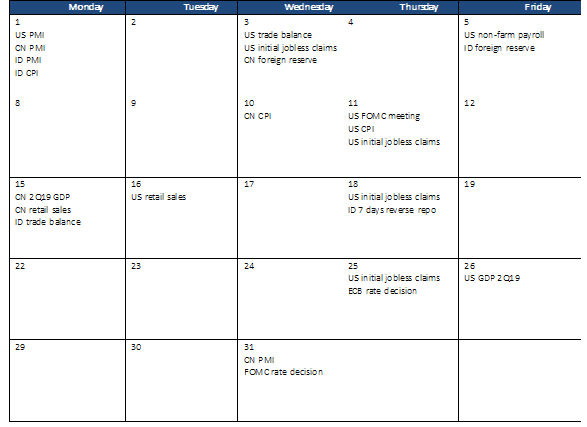

Calendar

July 2019

Foreign net purchases of Indonesia equities