30 September 2019

Weekly Market Review (30 Sep 2019) - What happened & What's next?

Market update

- Global indices ended the week lower with Dow Jones and S&P 500 declined by -1.0% WoW and -0.4% WoW, respectively. In the US, news has been focusing on the potential impeachment of President Trump, which could create uncertainty on the political situation heading into 2020 presidential election. On the other hand, news reports highlighted that Trump administration officials were in talks to limit US investors portfolio flows into China, a move that could add further pressure to the on-going US-China trade war. On the domestic side, foreign recorded net outflow of -USD134mn (11th consecutive week of net foreign outflow) with JCI index ended the week lower by -0.6% WoW to 6,196.9. Basic industry and Mining were the underperformers, fell by -3.2% WoW each, dragged down by cement, petrochemicals and coal names. On the other hand, the most outperformed was Miscellaneous sector, up by +0.6% WoW. News flows to be watched this week: US PMI, US new home sales, US 2Q19 GDP and US initial jobless claims.

- IDR depreciated to IDR 14,173 (-0.8%WoW), in line with average emerging markets. On the other hand, DXY strengthened by +0.6% WoW to 99.1.

- Risk off sentiment and lack of new positive catalyst made bond market yield increased by 7-8 bps. 10 years series increased the most.

- Foreign investor reported net inflow of IDR 2.03 Tn over the week.

- Concern on geopolitical risk and negative development on trade negotiation between US-China made 10 year US treasury yield decreased from 1.74% to 1.7%.

Global news

- News reports that US is planning to limit portfolio flows into China.

- Markit US manufacturing PMI recorded at 51.0, higher than consensus estimate of 50.4.

- Markit US services PMI recorded at 50.9, lower than consensus estimate of 51.4.

- US initial jobless claims for the week stood at 213,000, in-line with consensus estimate of 212,000.

Domestic News

- President Jokowi will submit an omnibus bill to lawmakers for an approval in the second period of his administration, as the govt. seeks to further streamline permits. Government is drafting an omnibus law on business licensing that will overhaul articles in 74 laws, in addition to another law on taxation. The concept of the omnibus law is estimated to be completed by Oct 2019. Furthermore, it also create standards to boost efficiency of online single submission, allowing investors to get permits in 30 minutes.

- Finance Ministry reported 8M19 state budget deficit of Rp199.1tn or 1.24% of GDP. This was higher vs 8M18 deficit of Rp150.5tn or 1.02% of GDP.

- Bank Indonesia (BI) estimates Indo economic growth to reach 5.1% in 3Q19. The realization in 2Q19 was +5.05%.

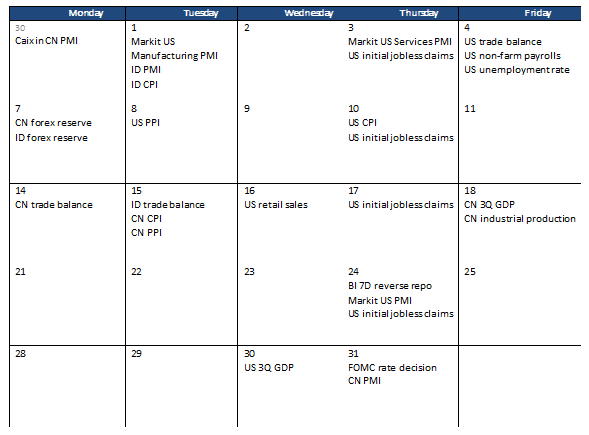

Calendar

October 2019

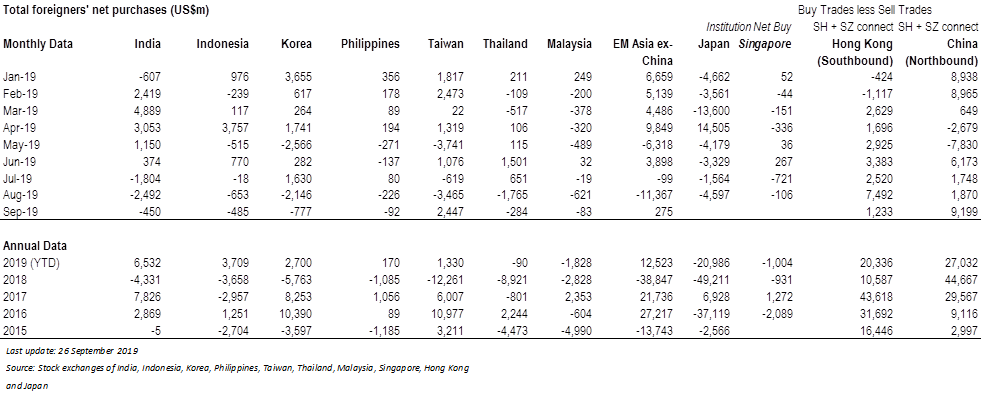

Foreign net purchases of Indonesia equities