21 October 2019

Weekly Market Review (21 Oct 2019) - What happened & What's next?

Market update

- Asian equities were boosted by two major positives last week. US-China announced a narrow-short term deal; while the UK entered into a deal with EU on Brexit possibly culminating into an orderly Brexit thus reducing tail risks. That said, on Saturday the UK Parliament delayed the crucial meaningful vote on Johnson’s new deal. In the US, earnings season started on a strong footing. If history is any guide, it is likely that this trend could continue given that the bar to beat Q3 consensus expectations of -4.7% YoY appears quite low. On domestic side, foreign investors continued to sell JCI for 14 consecutive weeks with a total outflow of USD95.57m from last week. Nonetheless, JCI strengthened to IDR6,191.9 (+1.4%WoW) by the end of the week. Basic industry was the best performer by gaining +7.3%WoW, thanks to higher chicken price. Meanwhile, Consumer sector was the biggest laggard, by falling -2.3%WoW. News flows to BI Rate decision and Indonesia Government’s cabinet announcement; US Initial Jobless Claims and PMI.

- IDR was relatively flat at IDR14,148 (-0.1%WoW), worse than average emerging markets (+0.6%WoW). On the other hand, DXY fell to 97.3 (-1%WoW).

- Continued foreign inflow push Indo bond yield down by 5 – 13bps with 10yr series decrease the most.

- Disappointing September US retail sales data, which mark the first decline in seven months raises concern regarding US economy growth. US household consumption, one of significant growth engine for US economy had shown sign of slowing down.

- While Brexit and trade talk were on a more positive tone last week. 10yr UST yield ended the week slightly increased to 1.75.

Global news

- US initial jobless claims increased 4,000 to a seasonally adjusted 214,000 (vs consensus of 215,000) for the week ended Oct. 12.

- US Retail sales decreased a seasonally adjusted -0.3%MoM in September, the first monthly decline since February. Excluding vehicles and gasoline, categories that can be volatile, September retail sales were flat.

- China Real GDP growth slowed to 6.0%YoY in 3Q19 from 6.2% in 2Q19 (2018: 6.6%), which was below market consensus (6.1%). This 6.0% quarterly growth reading marks the record low since 1992.

- China’s Industrial production (IP) and retail sales in September rose to 5.8% and 7.8%YoY, respectively, from 4.4% and 7.5% in August, but fixed asset investment (FAI) growth slowed to 5.4%YTD YoY in September from 5.5% in August.

- China’s import and export data for September came in worse than expected amid the country’s ongoing trade friction with the U.S. China’s exports fell 3.2%YoY in September, while imports dropped 8.5%YoY. The country’s total trade balance in September was USD39.65bn.

- China’s CPI posted +3.0%YoY in September, higher than 2.8%YoY in August and market expectations of 2.9%. It was a near 6-year high since November 2013. Accelerating food inflation was the major driver, while non-food inflation was largely muted. On a sequential basis, CPI inflation also quickened from to 0.7%MoM in August to 0.9%YoY in September.

Domestic News

- Trade balance recorded a deficit of -USD160.5m, while market estimated a surplus of USD325m, due to +2.8% YoY non-O&G import (Aug19: -8.9%). Meanwhile, the export figure was in-line with market expectation.

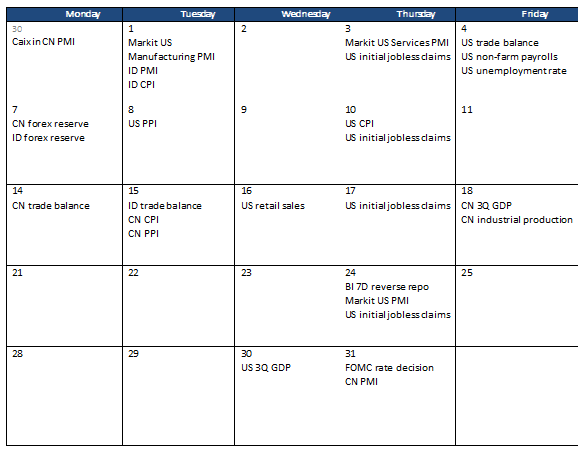

Calendar

October 2019

Foreign net purchases of Indonesia equities