26 March 2019

Weekly Market Review (25 March 2019) - What happened & What's next?

Market update

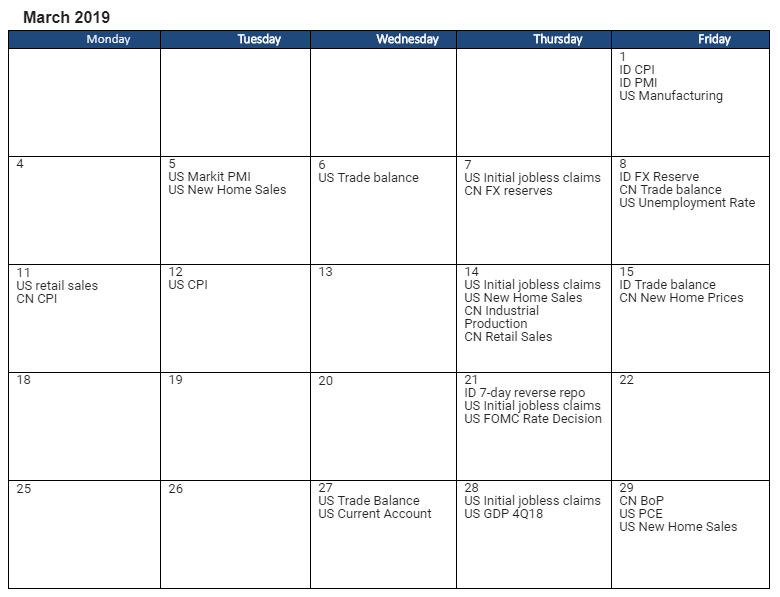

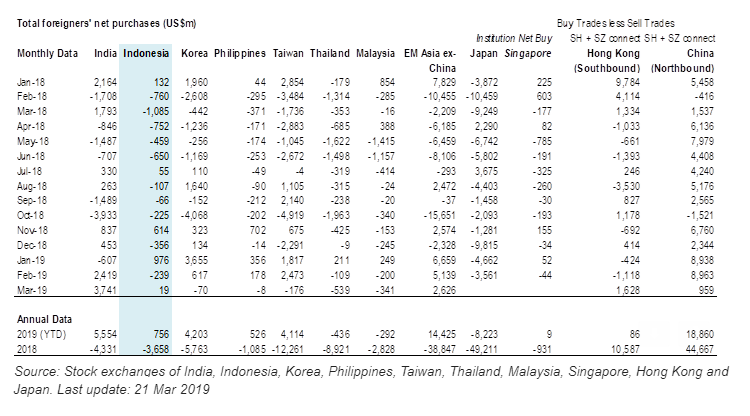

- US market moved to negative territory after poor Germany’s PMI data released on Friday (-1.9%DoD), wiping out previous days’ gains (-0.8%WoW). On the other hand, Asian equities edged higher this past week on dovish Fed and good corporate results out of China. The FOMC meeting confirmed the Fed’s bias shifting from tightening to a neutral policy stance with the committee indicating that possibility of rates hikes in 2019 is now down to zero. Central Banks in Indonesia, Thailand and Philippines also decided to stay on hold on rates as widely expected. Overall, Asia ex-JP equities (MXASJ, USD) ended the week up 1%. On domestic side, foreigners turned to be net buyers with USD94m inflow. As a results, JCI jumped +1%WoW to IDR6,525.3 by the end of the week. Bank and Property sector became the most outperformed sector by gaining +2.3%WoW due to more dovish statement from US Fed. Meanwhile, Agriculture sector was the biggest laggard with -1.6%WoW as the European Commission restricted the types of biofuels from the vegetable oil that may be counted toward its renewable-energy goals. Newsflows to be watched within this week include US Trade Balance, Current Account, PCE, New Home Sales and initial jobless claim; China Balance of Payment; US-China trade talks.

- IDR strengthened to IDR14,163 (+0.7%WoW), better than average emerging markets (-0.6%WoW). On the other hand, DXY was relatively flat at 96.7.

- Positive sentiment came from Fed dovish comment that signaling no interest rate hikes this year amid signs of economic slowdown. This made bond market yield decreased by 15- 24bps across the curve. 5 years series decreased the most.

- Foreign investor increased position by IDR11.4trn, mostly seen on 10 and 20 years series.

- Weak manufacturing data in Germany made 10 year Bund yield negative for the first time since 2016 to -0.017% . Concern on global growth also made 3-month Treasury bills down to 2.455%,while the US 10 year yield decreased from 2.59% to 2.44%. Spread between the three-month and 10-year yields inverted for the first time since 2007.

Global news

- US Initial Jobless Claims dropped 9,000 to a seasonally adjusted 221,000 (vs expectation of 225,000) for the week ended Mar. 16.

- Federal reserve Chairman Jerome Powell said interest rates could be on hold for "some time" as global risks weigh on the economic outlook and inflation remains muted. He added that they don't see data coming in that suggest that they should move in either direction.

Domestic News

- BI announced policy rate remains unchanged at 6% for the fourth straight month, in-line with market expectation. The central bank highlighted that interest rate and exchange rate policies will continue to focus on external stability, including lowering the current account deficit (CAD) to a manageable level.

- Indonesia's foreign debt reached USD383.3b (+7.2YoY) in January. BI regards the debt level as normal, marked by a higher growth in government borrowing rather than debt growth in the private sector.

- After planning to sue the European Union to the World Trade Organization regarding the discriminative treatment towards CPO. The government of Indonesia is threatening to retaliate by boycotting imported products from Europe.