16 December 2019

Weekly Market Review (16 Dec 2019) - What happened & What's next?

Market update

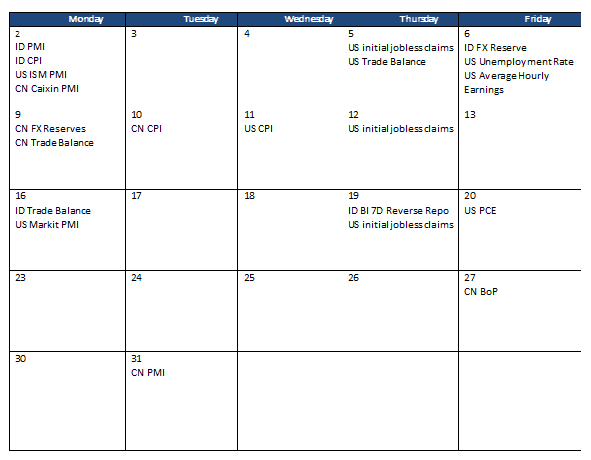

- Global indexes were closed higher last week as Brexit and US-China trade headwinds clear away. Optimism started on Thursday when Fed left interest rates unchanged while expressing optimism about US economic health. In addition, Boris Johnson’s (UK Prime Minister) Conservative Party has won the election, securing 365 chairs out of 650 chairs in the parliament. Thus, this gives Johnson a comfortable majority in the House of Commons and paves the way for Brexit to take place at the end of January. Meanwhile, on Friday, Trump said on Twitter that US and China were nearing a ‘big deal’ that could avoid fresh tariffs and potentially roll back some existing duties. On domestic side, JCI also booked a gain (+0.2% WoW) with Mining sector as the most outperforming sector, up by +3.7% WoW. On the other hand, Consumer and Infrastructure were the worst performing sectors, down by -1.5% WoW and -1.3% WoW respectively. News flows to be watched this week: Indonesia’s Trade balance, Indonesia 7 days reverse repo, US Markit PMI, US Initial jobless claims and US PCE.

- IDR strengthened to 13,990 (+0.3%WoW), in-line with the emerging market currencies. On the other hand, DXY weakened to 97.2 (-0.5% WoW).

- Despite the US-China trade de-escalation after phase one deal, bond market yield increased by 5-13 bps. 20 year series increased the most.

- Foreign investor increase position by IDR 2.61tn over the week. Trade volume decreased and dominated by short term bonds (1-5 years).

- After US and China have reached an agreement on text of a phase one trade deal, 10 year US Treasury decreased by 2 bps from 1.84% to 1.82% over the week.

Global news

- CPI rose 0.3% MoM in Nov-19, following an even bigger increase in Oct-19. This is mostly due to increase in the cost of rent and medical care. Prices also rose slightly for food, clothes, education and used vehicles. On the other hand, yearly core inflation rate remained unchanged at 2.3% YoY.

- China’s CPI rose 4.5% YoY in Nov-19 (the highest level this year), up from 3.8% YoY in the previous month. Pork prices rose 110.2% YoY, contributing 2.64% to the 4.5% CPI growth. However, month on month growth rate of pork prices in Nov-19 was 3.8%, down from 16.3% in Oct-19 as pork supply is restoring.

- China’s foreign exchange reserves fell by USD 9bn in Nov-19 to USD 3.1 trillion. The drop was higher than consensus expectation of USD 4bn.

- China’s exports fell -1.1% YoY in Nov-19, marking a fourth successive monthly decline as trade war was still ongoing. The dip was worse than consensus’ expectation of +0.8% YoY growth and worse than last month’s -0.9% YoY. Meanwhile, imports grew 0.3% YoY, the first monthly increase since April.

Domestic News

- Indonesia’s cabinet is discussing amending a legally imposed cap on budget deficit, which would allow the government to spend and borrow more to stimulate growth in Southeast Asia’s biggest economy. One option being considered by the cabinet is to change the deficit ceiling to an average of 3% over five years, enabling the budget gap to exceed 3% in any given year during that period. President Joko Widodo is holding talks on the matter, although for now, the current annual ceiling of 3% of GDP remains, the Finance Minister said

- Ministry of Energy & Mineral Resources sets a target of 155mn tons of coal domestic market obligation (DMO) next year. This represents a 21% increase over 2018 DMO target of 128mn tons.

- As of 10 December 2019, tax revenues realization only reached 74% of the target, translating into IDR1,167.4tn. Previously, the government set a tax shortfall target of IDR140tn in 2019. As such, the Ministry of Finance admits that there is likely to be a higher tax shortfall this year.

Calendar

December 2019

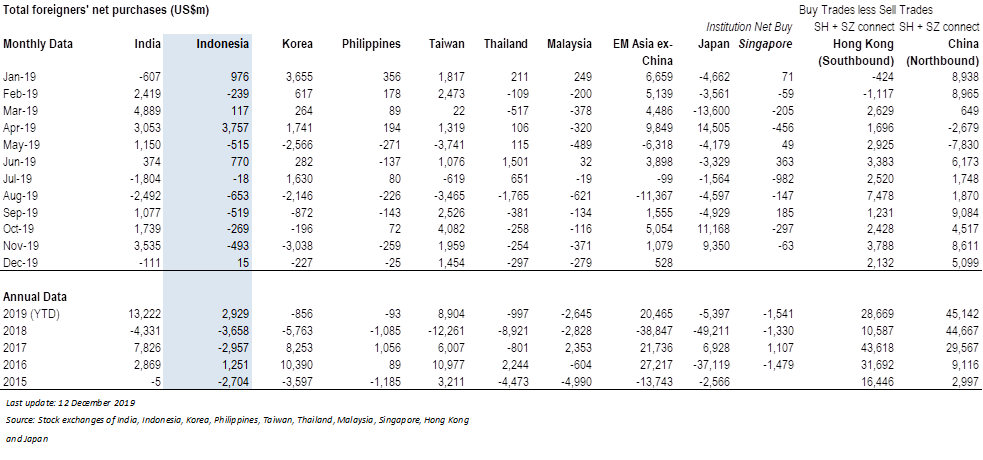

Foreign net purchases of Indonesia equities