14 January 2020

Weekly Market Review (13 Jan 2020) - What happened & What's next?

Market update

- Global indexes mostly closed higher last week due to easing tension between US and Iran as well as optimism on trade deal. On Wednesday, Trump said Iran appeared to be ‘standing down’ after an attack on Iraqi air bases housing US troops. In addition, investors were optimistic about next week’s signing of a “Phase one” trade deal between US-China. Yet, gain was lower on Friday as US jobs data was disappointing. The US economy added 145k jobs in Dec’19 vs consensus’ number of 160,000. Wage growth is also below expectation, only grew by +2.9%YoY (vs consensus at +3.1%YoY). On the other hand, domestic closed lower with JCI down by -0.8% WoW. The index was dragged down by Basic Industry sector (-3.3% WoW). Whereas the most outperformed sector was mining, up by +2.3% WoW. News flows to be watched within this week include US CPI, PPI, retail sales, initial jobless claims and industrial production; China trade balance and GDP.

- IDR strengthened to IDR13,772 (+1.1%WoW), better than average emerging markets. Similarly, DXY index also strengthened from 96.8 to 97.4.

- Risk on sentiment that came from decreasing geopolitical risk between US-Iran made strong demand from onshore and offshore investors. This made government bond yields declined by about 6-20 bps along the curve. 10 year government bond yield tumbled 17 bps to 6.89%.

- Foreign investor increased position by IDR6.98trn.

- Positive sentiment on preliminary trade deal with China next week and decreasing geopolitical risk between US-Iran made 10 year US treasury yield increased from 1.83% to 1.8%.

Global news

- US trade deficit dropped -8%YoY to 3 year low of USD43.1m in Nov’19 amid trade war with China. The deficit in goods with China fell another USD2.2bn in November to USD25.6bn.

- US factory orders fell 0.7%MoM in Nov-19, mark the third decline in four months. Durable-goods orders were down by 2.1% whereas orders for nondurable goods rose 0.6% in the month.

- US jobless claims fall for the fourth week in a row to 214,000, near the level of post-recession lows. However, the economy creates and erases tens of thousands of jobs at the end of each year, many of them temporary positions added during the holiday season. Jobless claims often swing up and down from Thanksgiving through early January. Yet, there is still no clear evidence that layoffs are rising or the labor market is weakening.

- China’s foreign exchange reserves in Dec’19 is better than expected, rose by USD12.3bn in Dec-19 to USD3.108trn.

- China’s CPI inflation remained unchanged at 4.5%YoY in Dec’19. Pork price inflation moderated to 97% from 110.2% in Nov’19.

Domestic News

- The Ministry of Law and Human Rights stated that the omnibus law plan for Employment Creation will be delivered to the Parliament in 16 January 2020, and as of now has completed by 95%.

- Indonesia plans to cut coal output to bolster price. Government set 2020 production target at 550m metric tons, -9.8%YoY vs 610m metric tons in 2019.

- Bank Indonesia (BI) stated that forex reserve in Dec’19 was at USD129.2bn, higher by USD2.6bn MoM. This forex position is adequate to support 7.6 months of imports and 7.3 months of import and foreign debt repayment, and above international adequacy standard.

- The Government has released the 2019 unaudited fiscal realization. Tax eventually reached IDR1,545trn—below the target and resulting a shortfall of IDR241trn. The non-tax revenue, fortunately, registered a realization of IDR405trn, larger than target, somewhat reducing the shortfall pressure. Hence, government widened the budget deficit to -2.2% of GDP from -1.8%.

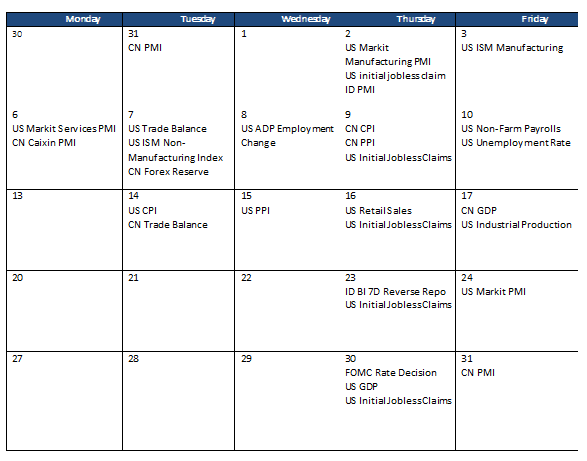

Calendar

January 2020

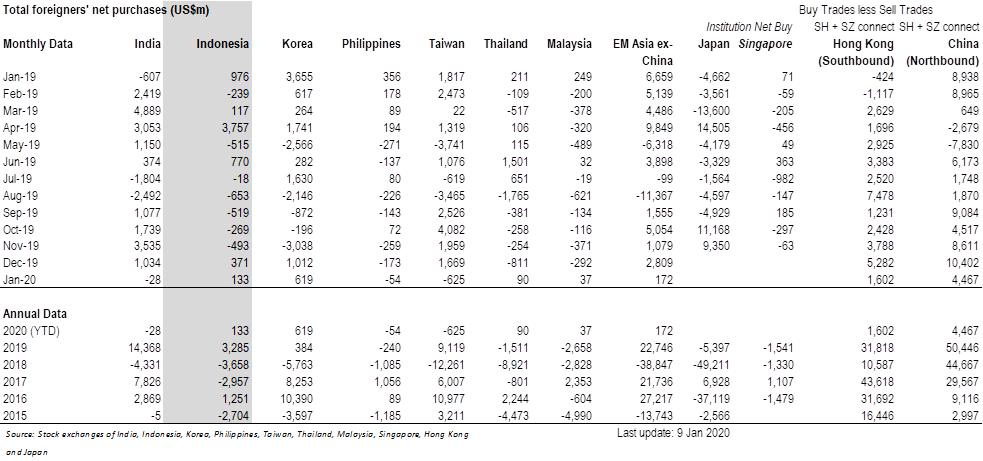

Foreign net purchases of Indonesia equities